This week was once again filled with some excitement. We got quite a big of good news from various companies reporting earnings, and the FED also gave us signs that the economy has bottomed, and the second half of the year should show some significant improvements. Next week, we get the normal weekly data mainly. Look at the ADP unemployment numbers for signs that the job market may start to be bottoming, and on the 8th, the wholesale inventory number should give us some insight into how fast supplies are flowing out to companies. Below is the complete list of economic data being released next Week.

- May 4 10:00 AM Construction Spending

- May 4 10:00 AM Pending Home Sales

- May 5 10:00 AM ISM Services

- May 6 8:15 AM ADP Employment Change

- May 6 10:30 AM Crude Inventories

- May 7 8:30 AM Initial Claims

- May 7 8:30 AM Productivity-Prel

- May 7 8:30 AM Unit Labor Costs

- May 7 3:00 PM Consumer Credit

- May 8 8:30 AM Average Workweek

- May 8 8:30 AM Hourly Earnings

- May 8 8:30 AM Nonfarm Payrolls

- May 8 8:30 AM Unemployment Rate

- May 8 10:00 AM Wholesale Inventories

In conclusion for this week. I like what I'm seeing market wise. I think we could easily see the dow at 900 by July or August if things continue the way they have been going. With the extra money in peoples paychecks starting April 1st, the 2nd Quarter earnings released in July could be quite nice for many corporations.

Thursday, April 30, 2009

Wednesday, April 29, 2009

List of ETF's

I often get emails from people asking me where they can find a list of some of the more popular ETFs that both allow you to invest into odd areas, as well as leverage both short and long, up to 30 times certain sectors or indexes. Well Here is a list of just some of my favorite ETFs (Exchange traded funds):

Triple Leverage

- Direxion Large Cap Bull 3x Shares (BGU)

- Direxion Small Cap Bull 3x Shares (TNA)

- Direxion Large Cap Bear 3x Shares (BGZ)

- Direxion Small Cap Bear 3x Shares (TZA)

Double Leverage and Short

- ProShares Ultra (2x) Dow30 (DDM)

- ProShares Short Dow30 (DOG)

- ProShares UltraShort (2x) Dow30 (DXD)

- ProShares Ultra (2x) S&P500 (SSO)

- ProShares Short S&P 500 (SH)

- ProShares UltraShort (2x) S&P500 (SDS)

- ProShares UltraShort (2x) MidCap400 (MZZ)

- ProShares Ultra (2x)MidCap400 (MVV)

- ProShares Ultra (2x) QQQ (QLD)

- ProShares Short QQQ (PSQ)

- ProShares UltraShort (2x) QQQ (QID)

- ProShares Ultra (2x) Russell 2000 (UWM)

- ProShares Short Russell 2000 (RWM)

- ProShares UltraShort (2x) Russell 2000 (TWM)

- ProShares Ultra (2x) Financials (UYG)

- ProShares UltraShort (2x) Financials (SKF)

- ProShares Ultra (2x) Real Estate (URE)

- ProShares UltraShort (2x) Real Estate (SRS)

- ProShares Ultra (2x) Basic Materials (UYM)

- ProShares UltraShort (2x) Basic Materials (SMN)

- ProShares UltraShort (2x) Oil & Gas (DUG)

- ProShares Ultra (2x) Semiconductors (USD)

- ProShares Ultra (2x) Technology (ROM)

Other ETFs I like:

- (USO) Tracks Oil Prices

- (GLD) Tracks Gold Prices

- (DXO) Track Oil Prices with 2X Leverage

Triple Leverage

- Direxion Large Cap Bull 3x Shares (BGU)

- Direxion Small Cap Bull 3x Shares (TNA)

- Direxion Large Cap Bear 3x Shares (BGZ)

- Direxion Small Cap Bear 3x Shares (TZA)

Double Leverage and Short

- ProShares Ultra (2x) Dow30 (DDM)

- ProShares Short Dow30 (DOG)

- ProShares UltraShort (2x) Dow30 (DXD)

- ProShares Ultra (2x) S&P500 (SSO)

- ProShares Short S&P 500 (SH)

- ProShares UltraShort (2x) S&P500 (SDS)

- ProShares UltraShort (2x) MidCap400 (MZZ)

- ProShares Ultra (2x)MidCap400 (MVV)

- ProShares Ultra (2x) QQQ (QLD)

- ProShares Short QQQ (PSQ)

- ProShares UltraShort (2x) QQQ (QID)

- ProShares Ultra (2x) Russell 2000 (UWM)

- ProShares Short Russell 2000 (RWM)

- ProShares UltraShort (2x) Russell 2000 (TWM)

- ProShares Ultra (2x) Financials (UYG)

- ProShares UltraShort (2x) Financials (SKF)

- ProShares Ultra (2x) Real Estate (URE)

- ProShares UltraShort (2x) Real Estate (SRS)

- ProShares Ultra (2x) Basic Materials (UYM)

- ProShares UltraShort (2x) Basic Materials (SMN)

- ProShares UltraShort (2x) Oil & Gas (DUG)

- ProShares Ultra (2x) Semiconductors (USD)

- ProShares Ultra (2x) Technology (ROM)

Other ETFs I like:

- (USO) Tracks Oil Prices

- (GLD) Tracks Gold Prices

- (DXO) Track Oil Prices with 2X Leverage

GDP Fell at 6.1% Annualized Rate

The United States GDP (Gross domestic product) fell at an annualized rate of 6.1% for the 1st quarter of 2009. This was less then the rate it fell at in the 4th Quarter of 2008, which was 6.3%, which means things are improving in the economy in general.

I just wanted to point out today, that all those people saying "we are headed to another Depression," couldn't have been further from reality. Let me explain to you all what a depression is. A Depression (Not the great depression, which was even worse) means that GDP falls at an annualized rate of 10% for 4 straight quarters. That's an average of 2.5% each quarter for 4 quarters. Considering that our annualized rate of decline was 6.3% and 6.1% respectedly for the 4th and 1st quarters, we are far from "Depression" levels. We would need to almost double the declines and have the declines persist for twice as ling as they already have to even consider a Depression scenario.

Unless a major unforeseen economic event strikes at the heart of the Nations economy, we will not even be close to Depression status anytime in the near future. The government has many, many new tools at it's desposal to combat a lessenign money supply, and put cash back into peoples pockets. Maybe next time the media begins to tout the current economic problems as a possible Depression scenario, you will take the time to go against the herd and invest in solid, debt free companies.

I just wanted to point out today, that all those people saying "we are headed to another Depression," couldn't have been further from reality. Let me explain to you all what a depression is. A Depression (Not the great depression, which was even worse) means that GDP falls at an annualized rate of 10% for 4 straight quarters. That's an average of 2.5% each quarter for 4 quarters. Considering that our annualized rate of decline was 6.3% and 6.1% respectedly for the 4th and 1st quarters, we are far from "Depression" levels. We would need to almost double the declines and have the declines persist for twice as ling as they already have to even consider a Depression scenario.

Unless a major unforeseen economic event strikes at the heart of the Nations economy, we will not even be close to Depression status anytime in the near future. The government has many, many new tools at it's desposal to combat a lessenign money supply, and put cash back into peoples pockets. Maybe next time the media begins to tout the current economic problems as a possible Depression scenario, you will take the time to go against the herd and invest in solid, debt free companies.

Tuesday, April 28, 2009

Consumer Confidence Shoots Up, and More Good News

Despite the worry about the swine flu in the markets, which, if you read my last post you know I think is a bit over done, the markets are up today as I write this. There are 2 main reasons investors are looking at stocks more optimistically today after a bit of a sell off to start the week off:

Consumer Confidence Sky Rockets:

In the month of April, consumers gained a tremendous amount of confidence. The key index surged 12 points to 39.2 from a revised 26.9 for the month of March. This represent the largest increase in the index for quite a while, and in my opinion clearly shows sentiment both in investors and consumers minds have turned. I'm guessing that the fact that the stock market had rebounded this month, has given consumers more reason to be optimistic about the general economy. This is great because as their confidence rises, they spend more money, allowing business's to make more money, hire more employees, and give consumers even more confidence. Just like we had a downward spiral of bad news cause and effects, the opposite seems to now be occurring.

Home Prices Declining at Slower Pace:

The other piece of good news is for homeowners. The prices of home in 20 key cities of the United states has slowed it's pace of decline. This can lead to banks offering mortgages with more ease, and a general wealth perception for homeowners, which could further increase Consumer Confidence next month.

I think the economy has clearly bottomed, and things should be up from here, with a few bumps along the way. Should you invest in the market? If you have some extra cash, then go for it, in my opinion.

Consumer Confidence Sky Rockets:

In the month of April, consumers gained a tremendous amount of confidence. The key index surged 12 points to 39.2 from a revised 26.9 for the month of March. This represent the largest increase in the index for quite a while, and in my opinion clearly shows sentiment both in investors and consumers minds have turned. I'm guessing that the fact that the stock market had rebounded this month, has given consumers more reason to be optimistic about the general economy. This is great because as their confidence rises, they spend more money, allowing business's to make more money, hire more employees, and give consumers even more confidence. Just like we had a downward spiral of bad news cause and effects, the opposite seems to now be occurring.

Home Prices Declining at Slower Pace:

The other piece of good news is for homeowners. The prices of home in 20 key cities of the United states has slowed it's pace of decline. This can lead to banks offering mortgages with more ease, and a general wealth perception for homeowners, which could further increase Consumer Confidence next month.

I think the economy has clearly bottomed, and things should be up from here, with a few bumps along the way. Should you invest in the market? If you have some extra cash, then go for it, in my opinion.

Monday, April 27, 2009

Swine Flu Pointlessly Affecting the Markets?

The Stock Market is at least starting out lower today, oil is down over 5%, and the European Union is advising their citizens not to travel to the United states unless absolutely necessary all because 20 people have a form of the flu, Swine Flu, in the United States. There were more reports in Mexico as well.

Does this sound crazy to you or what? The Swine Flu for those of you who are not aware, had a minor outbreak in the United states in 1976, and pretty much causes the common symptoms we all associate with the flue virus, which is running nose, sneezing, fever, headache, sore throat, vomiting, etc. The virus is initially picked up by people who work around pigs (swine) and then it is spread from human to human just like any flue virus is spread.

Airline, and cruise line stocks are really being hit hard from this news which started to break early this weekend, for fears that an epidemic could slow the travel industry as well as the global economy more then it already has been slowed down by the recession. In my opinion it's likely not going to have a major impact on the bottom line of these or any companies stocks, and it's probably not a bad idea to take this time to consider getting into the airline and cruise line stocks if you have been waiting to.

Of course with these types of things, the media will pick up any negatives they can to try and scare their audience into watching more of their new shows. Be cautious, but also realize that markets often over react in these cases.

Does this sound crazy to you or what? The Swine Flu for those of you who are not aware, had a minor outbreak in the United states in 1976, and pretty much causes the common symptoms we all associate with the flue virus, which is running nose, sneezing, fever, headache, sore throat, vomiting, etc. The virus is initially picked up by people who work around pigs (swine) and then it is spread from human to human just like any flue virus is spread.

Airline, and cruise line stocks are really being hit hard from this news which started to break early this weekend, for fears that an epidemic could slow the travel industry as well as the global economy more then it already has been slowed down by the recession. In my opinion it's likely not going to have a major impact on the bottom line of these or any companies stocks, and it's probably not a bad idea to take this time to consider getting into the airline and cruise line stocks if you have been waiting to.

Of course with these types of things, the media will pick up any negatives they can to try and scare their audience into watching more of their new shows. Be cautious, but also realize that markets often over react in these cases.

Friday, April 24, 2009

Important Stock Earnings Reports for Next Week

This week was dull in terms of economic data, but exciting in terms of earnings data. The economic data this week was not very good. Most of the trends that we hoped were emerging, after the data the last few weeks began showing a possible recovery in areas, such as first time unemployment claims, manufacturing index, etc, have taken a turn down again with this weeks data. Having said this, companies like Google, American Express, Apple, Intel, Black and Decker, JetBlue, and others surprised us with their much better then expected earnings for the 1st quarter of 2009. What is in store for next week? Well, there are still a lot of earnings reports coming, especially in Health care and Biotech. Then you have this laundry list of economic data releases throughout the week, which may shed further light on the general economy.

Date Time (ET) Statistic

- Apr 28 9:00 AM Consumer Confidence

- Apr 28 10:00 AM S&P/CaseShiller Home Price Index

- Apr 29 8:30 AM GDP-Adv.

- Apr 29 8:30 AM Chain Deflator-Adv.

- Apr 29 10:35 AM Crude Inventories

- Apr 29 2:15 PM FOMC Rate Decision

- Apr 30 8:30 AM Initial Claims

- Apr 30 8:30 AM Personal Income

- Apr 30 8:30 AM Personal Spending

- Apr 30 8:30 AM Employment Cost Index

- Apr 30 9:45 AM Chicago PMI

- May 1 9:55 AM Mich Sentiment-Rev

- May 1 10:00 AM Factory Orders

- May 1 10:00 AM ISM Index

- May 1 2:00 PM Auto Sales

- May 1 2:00 PM Truck Sales

Date Time (ET) Statistic

- Apr 28 9:00 AM Consumer Confidence

- Apr 28 10:00 AM S&P/CaseShiller Home Price Index

- Apr 29 8:30 AM GDP-Adv.

- Apr 29 8:30 AM Chain Deflator-Adv.

- Apr 29 10:35 AM Crude Inventories

- Apr 29 2:15 PM FOMC Rate Decision

- Apr 30 8:30 AM Initial Claims

- Apr 30 8:30 AM Personal Income

- Apr 30 8:30 AM Personal Spending

- Apr 30 8:30 AM Employment Cost Index

- Apr 30 9:45 AM Chicago PMI

- May 1 9:55 AM Mich Sentiment-Rev

- May 1 10:00 AM Factory Orders

- May 1 10:00 AM ISM Index

- May 1 2:00 PM Auto Sales

- May 1 2:00 PM Truck Sales

Thursday, April 23, 2009

Stock Earnings Surprises

I thought I'd take this Thursday to be a bit optimistic, not that I haven't already been in most of my older posts. US corporations do not generally seem to be in as bad shape as expected, especially the technology section. Google, Apple, Intel, and others have all reported in the last ten days, and they have pretty much blown out analysts estimates. Has the gloom and doom from the media affected their estimates to the negative side?

What Do these Surprises Mean?

When companies like Apple, who sell products at very large mark ups, and are usually more expensive then their competitors, show signs that the economy is not affecting them as much as most experts thought it would, I think there may have been some gross underestimates. I'm not here saying that the dow will shoot up to 9,000 or 10,000 within weeks, or months, but I do think that there will continue to be many more earnings surprises especially in the next 2 Quarters.

Tech Companies

Look for innovation to really show it's teeth in the next few quarters. I expect Apple to release a new product soon, sort of a mix between a Netbook, and an Ipod. I'm guessing it will be a suped up larger screen ipod with capabilities to pretty much do everythign a desktop could do. I also See Google making a major acquisition or two. Twitter? Maybe. But I also think they will continue to innovate themselves, possibly slowly releasing an online harddrive service, as well as maybe even acquiring the newly announced cloud computer video game system Onlive.

Banks

The big question is, how bad shape are the banks really in? They have all been reporting profits much higher then analysts predicted, but can they all survive, continued write-downs, foreclosures, and the mess in the credit markets? Tommorow the first Bank Stress tests will be released to the Obama administration. Although the public won't get the specifics, it will tell the administration how solid the main US banks are. Personally I expect most bank stocks to have nice runs in the next 6-12 months. Once the economy is in the all clear, the banks that did survive and acquire other investment firms and banks, will be in a strong position for the future.

What Do these Surprises Mean?

When companies like Apple, who sell products at very large mark ups, and are usually more expensive then their competitors, show signs that the economy is not affecting them as much as most experts thought it would, I think there may have been some gross underestimates. I'm not here saying that the dow will shoot up to 9,000 or 10,000 within weeks, or months, but I do think that there will continue to be many more earnings surprises especially in the next 2 Quarters.

Tech Companies

Look for innovation to really show it's teeth in the next few quarters. I expect Apple to release a new product soon, sort of a mix between a Netbook, and an Ipod. I'm guessing it will be a suped up larger screen ipod with capabilities to pretty much do everythign a desktop could do. I also See Google making a major acquisition or two. Twitter? Maybe. But I also think they will continue to innovate themselves, possibly slowly releasing an online harddrive service, as well as maybe even acquiring the newly announced cloud computer video game system Onlive.

Banks

The big question is, how bad shape are the banks really in? They have all been reporting profits much higher then analysts predicted, but can they all survive, continued write-downs, foreclosures, and the mess in the credit markets? Tommorow the first Bank Stress tests will be released to the Obama administration. Although the public won't get the specifics, it will tell the administration how solid the main US banks are. Personally I expect most bank stocks to have nice runs in the next 6-12 months. Once the economy is in the all clear, the banks that did survive and acquire other investment firms and banks, will be in a strong position for the future.

Wednesday, April 22, 2009

3 Ways to Protect Yourself Against Inflation

Right now Inflation is probably the last thing on peoples minds. As an investor you are probably more worried about your stock portfolio, your home value, or your job. Having said this, with all the money the United States Government as well as other governments around the world have been pumping into the Economy, there is sure to be heavy inflation in the next year or two. Some economists even venture to say that inflation could rival the double digit numbers we have seen in the 1970's. I don't think it will get that bad, but I do think you should consider protecting your self against inflation. Here are 3 quick investment methods to do so:

- Buy Gold - Gold is probably one of the best hedges agianst inflation. As the value of the dollar falls with inflation, the amount of gold that the dolalr can buy decreases, making it more valuable.

- Exchange Traded funds (ETFs) - which are inverse treasuries or inflation. Ticker (TIP) is a fund which invests in instruments that are the inverse of inflation. If inflation rises you will get a return that inflation won't effect. (RYJUX) is another fund which is the inverse of treasuries, standing for "Rydex Inverse Gov Long Bond Strategy". As inflation rises, government bond values fall. This invests in Vehicles which are inverse of that.

- Buy a Home - We may not see run ups in prices liek we have in the past, but a house is a great inflation protected asset.

Tuesday, April 21, 2009

Stocks Still Cheap - My High Dividend Picks

Alright, well yesterday was a major sell off, and it looks like today may continue the fire sale. After a run up like the one we had the last 4 weeks, a pullback is to be expected. Having said this I think we are at another buying opportunity. Could stocks go lower? Sure, but they are very cheap. Below are a few stocks that seem very cheap if you are looking for dividends. Keep in mind that a 5+% dividend is paying pretty much double of what a bank Certificate of Deposit is paying, plus you have the upside of the stock to factor in as well if you are a long term investor.

British Petroleum - (BP) - Dividend Yield - 8.64%

Great stock, oil demand will soar once the economy picks up. Also oil is a great way to hedge against future inflation which is all but a sure thing.

Reynolds American - (RAI) - Dividend Yield - 8.66%

They make cigarettes. If you don't see a moral issue in investing in them, go for it. Although there has been an increase in cigarette taxes, people are still buying them. They also have a line of new tobacco products, that are contraversial, but profitable. At 8.66%, this dividend is amazing. Reynolds America is a great stock for uncertain markets in that it usually trades in a less volatile manner.

Intel - (INTC) - Dividend Yield - 3.73%

A technology company, that is growing, yet paying a dividend 1% higher then the average Bank CD? Yep, Intel is by far the leader of computer chip makers. The company continues to expand, and will be back above $20 a share easily once the economy recovers. Intel took a bit of a hit last earnings call when they didn't give specific about the future outlook. I Say, buying opportunity.

As long as you are in the stock market for the long run (at least 2 years) I think you will certainly see substantial gains plus be paid to hold the stocks (via dividend payout) over the next several months and years. I also like some of the bond funds out there that are a bit more risky but pay over 10%.

British Petroleum - (BP) - Dividend Yield - 8.64%

Great stock, oil demand will soar once the economy picks up. Also oil is a great way to hedge against future inflation which is all but a sure thing.

Reynolds American - (RAI) - Dividend Yield - 8.66%

They make cigarettes. If you don't see a moral issue in investing in them, go for it. Although there has been an increase in cigarette taxes, people are still buying them. They also have a line of new tobacco products, that are contraversial, but profitable. At 8.66%, this dividend is amazing. Reynolds America is a great stock for uncertain markets in that it usually trades in a less volatile manner.

Intel - (INTC) - Dividend Yield - 3.73%

A technology company, that is growing, yet paying a dividend 1% higher then the average Bank CD? Yep, Intel is by far the leader of computer chip makers. The company continues to expand, and will be back above $20 a share easily once the economy recovers. Intel took a bit of a hit last earnings call when they didn't give specific about the future outlook. I Say, buying opportunity.

As long as you are in the stock market for the long run (at least 2 years) I think you will certainly see substantial gains plus be paid to hold the stocks (via dividend payout) over the next several months and years. I also like some of the bond funds out there that are a bit more risky but pay over 10%.

Monday, April 20, 2009

5 Reasons Why the Recession is good

"Recession" and "good" in the same sentence? Yes, despite the obvious negative impacts of a strong recession like we are having right now, there are actually quite a few positive things that can come out of a strong recession.

- Financial Reform - Whether you like regulation or not, there will be a lot more of it. Each and every major recession, or Depression, teaches the country how to prevent the same circumstances from occurring again. We learned a lot from the Great Depression, and will learn a lot from this economic mess as well.

- Wakes People Up - There is no doubt, that losing 40% in your 401k plan will wake you up. Those Americans who have been spending way more then they could afford, are now going back to the basics. Valuing time spent with family over that spent in the new Porshe, or in front of the new 60 inch lcd tv.

- Prevention of a Giant Multi faceted Bubble - Without cyclical downturns, investments would all be giant bubbles. Wheather it be stocks runnign up to have a PE ratio of 50, or the housing market pricing out most families, the lack of a downturn would obviously cause large bubbles to form which would eventually pop.

- Promote Efficiencies - Yes, jobs are being cut, and people are in trouble, but the recession has caused everyone, families as well as corporations to cut back their spending and squeeze as much as they can out of every dollar. They are become more efficient with what they have. When things do turn around, they will be in a position to enjoy and take advantage of the turnaround.

- Everything is Cheap and Affordable to Different Groups - The recession has actually hurt the rich more then the poor in terms of total wealth. Having said this, the Poor may be facing more problems then the wealthy, but will now possibly be able to afford a new home, and invest in stocks which in my opinion are grossly undervalued.

Thursday, April 16, 2009

Next Weeks Stock Market Movers

Next week is sort of an odd one for the market. After seeing a very nice run up in stocks this week and last, next week could be a big week which will tell us if we will remain in this Bull rally, or possibly fall down a notch or two. This week we had Earnings released from Google, JP Morgan, and Intel, and none of them were too bad. Next weeks we have the following Economic data being released. It's not a week filled with important data. In fact there isn't much scheduled to be released that will affect the overall market too much:

- Apr 20 10:00 AM Leading Indicators

- Apr 22 10:35 AM Crude Inventories

- Apr 23 8:30 AM Initial Claims 04/18

- Apr 23 10:00 AM Existing Home Sales

- Apr 24 8:30 AM Durable Orders Mar

- Apr 24 8:30 AM Durable Orders, Ex-Auto Mar

- Apr 24 10:00 AM New Home Sales Mar

Switching gears though, Next week is a big week for earnings reports as well as unscheduled information. Besides hundreds of companies, most importantly Bank of America, Apple, and IBM reporting their earnings, the Obama administration will also be releasing information about the first bank stress tests. The market could react heavily on whatever this report from Obama will say.

- Apr 20 10:00 AM Leading Indicators

- Apr 22 10:35 AM Crude Inventories

- Apr 23 8:30 AM Initial Claims 04/18

- Apr 23 10:00 AM Existing Home Sales

- Apr 24 8:30 AM Durable Orders Mar

- Apr 24 8:30 AM Durable Orders, Ex-Auto Mar

- Apr 24 10:00 AM New Home Sales Mar

Switching gears though, Next week is a big week for earnings reports as well as unscheduled information. Besides hundreds of companies, most importantly Bank of America, Apple, and IBM reporting their earnings, the Obama administration will also be releasing information about the first bank stress tests. The market could react heavily on whatever this report from Obama will say.

Google Earnings Report a Blowout?

Is Google About to Blow Out Earnings? As many of you know who have read my postings in the past, I am a huge fan of Google. Today at a little after 4 pm est they will announce their 2009 Quarter 4 earnings. The analysts have estimated that Google will report earnings of $4.93 per share on Revenue of 4.08 Billion. Whether they beat those estimates or not doesn't really have me too concerned, being a long term shareholder. I own quite a bit of stock, and thought that, today on Googles BIG day I would go over a few of the reasons I think they will continue to grow at a rapid pace:

- They are Entering the Mobile Market with a fury. In less than a year since they launched their Android mobile phone operating system, they have already taken over 5% of the worlds market share. With Mobile advertising expected to be in the $10 billion plus range by 2012, this will ad an incredible amount of revenue for the company.

- Google knows all. They really do. They have access to so much information that they can predict trends before anyone else. This will allow them to have the first mover advantage in a variety of fields. They can predict much better then anyone else what people will do, what they like, etc. This is be a huge advantage when they start investing into the Google Venture Capital operation.

- Android Expansion? Yep, there is already talk of the first nonsmartphone Android platform, a netbook which runs on the Operating system. Whats next, a full fledged desktop OS? That's pretty clear to me. They are taking on Microsoft in just abotu every area.

Wednesday, April 15, 2009

Why Stock Earnings This Quarter Don't Matter so Much

It's that time of the year again, where 1st quarter earnings for many large companies are due out. Intel, Goldman Sachs, Well Fargo, have all released their earnings, and Google as well as other large companies prepare to this week and next. So, what exactly are we looking for with these earnings reports?

We already know this is probably going to be the worse Quarter in years for many companies. With economic data showing the economy seems to be at least on a slight rebound, it is likely that most of these companies will report better numbers come July for their 2nd quarter. So, should and will these numbers effect the stock all that much? Well, any quarterly report is bound to get a stock price reaction in the short term, but if you are in these stocks for two years or more, don't sweet this quarters earnings. Take for example Intel. Their stock is down 5% after reporting numbers that were seemingly in line with forecasts by analysts. Since they didn't give clear guidance for next quarter the stock is hurting. As an investor though, you have to take the optimistic view. Intel is pretty much the only major computer chip maker worth mentioning, besides AMD which is falling further behind each quarter. When the economy rebounds, they will be in a position better then ever to take a commanding lead in this market as they grow not only in scale, but also in scope. There is no reason they stock will not approach the 52 week high of $25 sometime in the near future, not to mention their current, dividend which seems secure is paying more then any bank CD you will find.

In conclusion I think this quarters earnings reports, if for a company with little or no debt, a clean balance sheet, and a bright future, should not be read too much into. This quarters earnings may in fact make for some great buying opportunities if you are looking for solid long term investments.

We already know this is probably going to be the worse Quarter in years for many companies. With economic data showing the economy seems to be at least on a slight rebound, it is likely that most of these companies will report better numbers come July for their 2nd quarter. So, should and will these numbers effect the stock all that much? Well, any quarterly report is bound to get a stock price reaction in the short term, but if you are in these stocks for two years or more, don't sweet this quarters earnings. Take for example Intel. Their stock is down 5% after reporting numbers that were seemingly in line with forecasts by analysts. Since they didn't give clear guidance for next quarter the stock is hurting. As an investor though, you have to take the optimistic view. Intel is pretty much the only major computer chip maker worth mentioning, besides AMD which is falling further behind each quarter. When the economy rebounds, they will be in a position better then ever to take a commanding lead in this market as they grow not only in scale, but also in scope. There is no reason they stock will not approach the 52 week high of $25 sometime in the near future, not to mention their current, dividend which seems secure is paying more then any bank CD you will find.

In conclusion I think this quarters earnings reports, if for a company with little or no debt, a clean balance sheet, and a bright future, should not be read too much into. This quarters earnings may in fact make for some great buying opportunities if you are looking for solid long term investments.

Monday, April 13, 2009

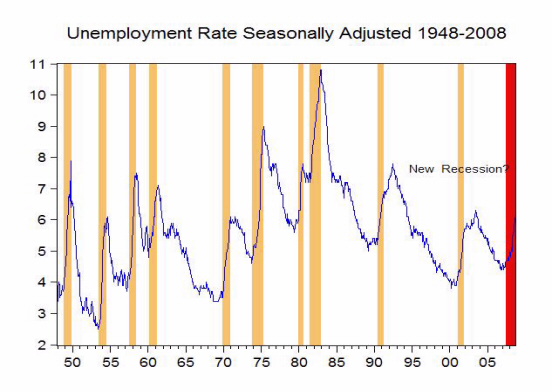

Historical: Unemployments Relationship to A Recession

Just how bad will unemployment get before it starts to turn around? Well, we can't answer that question, but we can tell you, that the rate will likely continue to increase until the recession is over, and could still increase after the recession has ended and we are well into a recovery. Unemployment rate is a lagging indication. This means that it doesn't turn around until after the general economy has. If you look at the chart above, you can see the yellow shaded areas are confirmed recessionary periods since 1948. The blue line shows the unemployment rate for the last 60 years. It's a little bit scary looking at the last two recessions, of 2000-01, and 1990-91. The unemployment rate in both cases continued to rise 18 months after each recession ended. Besides these two recessions though, which were generally mild, the unemployment rate seems to start it's decline at the end of the recession. My prediction is that this recession will official end sometime in the 3rd quarter of this year, and the unemployment rate will begin falling probably in or around September.

Saturday, April 11, 2009

2008 Celebrity Earnings

Did you ever wonder how your earnings stacked up with celebrities, including musicians, sports stars, and TV public personalities? Well Here is a glimpse at what some of the earnings for 2008 were of these famous people:

Tyler Perry - $125 million

Tiger Woods -$110 million

Jay-Z - $82 million

Beyonce - $80 million

Rush Limbaugh - $38 million

Alex Rodriguez - $34 million

Will Ferrell - $31 million

Jennifer Aniston - $27 million

Kelly Ripa - $8 million

Danica Patrick - $7 million

Tina Fey - $4.6 million

Patrick Dempsey - $3.5 million

Britney Spears - $2.25 million

Sarah Palin - $125,000

If you thought of these as day jobs, and these people worked the average 40 hour work week, their average hourly wages would look as follows:

Tyler Perry - $62,150 an hour

Tiger Woods -$52,880 an hour

Jay-Z - $39,423 an hour

Beyonce - $38,461 an hour

Rush Limbaugh - $18,269 an hour

Alex Rodriguez - $16,346 an hour

Will Ferrell - $14,423 an hour

Jennifer Aniston - $12,980 an hour

Kelly Ripa - $3,846 an hour

Danica Patrick - $3,365 an hour

Tina Fey - $2,211 an hour

Patrick Dempsey - $1,682 an hour

Britney Spears - $1080 an hour

Sarah Palin - $60 an hour

Tyler Perry - $125 million

Tiger Woods -$110 million

Jay-Z - $82 million

Beyonce - $80 million

Rush Limbaugh - $38 million

Alex Rodriguez - $34 million

Will Ferrell - $31 million

Jennifer Aniston - $27 million

Kelly Ripa - $8 million

Danica Patrick - $7 million

Tina Fey - $4.6 million

Patrick Dempsey - $3.5 million

Britney Spears - $2.25 million

Sarah Palin - $125,000

If you thought of these as day jobs, and these people worked the average 40 hour work week, their average hourly wages would look as follows:

Tyler Perry - $62,150 an hour

Tiger Woods -$52,880 an hour

Jay-Z - $39,423 an hour

Beyonce - $38,461 an hour

Rush Limbaugh - $18,269 an hour

Alex Rodriguez - $16,346 an hour

Will Ferrell - $14,423 an hour

Jennifer Aniston - $12,980 an hour

Kelly Ripa - $3,846 an hour

Danica Patrick - $3,365 an hour

Tina Fey - $2,211 an hour

Patrick Dempsey - $1,682 an hour

Britney Spears - $1080 an hour

Sarah Palin - $60 an hour

Friday, April 10, 2009

Google First Quarter Earnings and More

As I mentioned int he previous post, Next week is probably one of the more important weeks for the market that we have seen in quite a while. Not only is a huge array of data coming out throughout the week, but many of the largest companies, especially in Tech are reporting their earnings. These earnings reports will give the market an idea about just how bad things have been for the 1st quarter of 2009. The following are some of the dates and larger companies reporting earnings this week.

Tuesday April 14th

Intel Corporation - After Market Close - Expected $0.02 per share

Johnson & Johnson - Time not Given - Expected $1.22 per share

Wednesday April 15th

Piper Jaffray - Before Market Opens - Expected -$0.17 per share

Thursday April 16th

JPMorgan Chase & Co. - 6:30am - Expected $0.31 per share

Google - After Market Close - Expected $4.95 per share

Harley Davidson - Before Market Open - Expected $0.51 per share

Nokia - Time Not Given - Expected $0.15 per share

Friday April 17th

General Electric - Before Market Open - Expected $0.21 per share

Citigroup Inc - Before Market Open - Expected -$0.36 per share

The following week may be just as big. I am really curious to see how well Google does, as they seem to be a good barometer for the tech sector in general. Their stock is up 40% from it's lows just 2 months ago.

Tuesday April 14th

Intel Corporation - After Market Close - Expected $0.02 per share

Johnson & Johnson - Time not Given - Expected $1.22 per share

Wednesday April 15th

Piper Jaffray - Before Market Opens - Expected -$0.17 per share

Thursday April 16th

JPMorgan Chase & Co. - 6:30am - Expected $0.31 per share

Google - After Market Close - Expected $4.95 per share

Harley Davidson - Before Market Open - Expected $0.51 per share

Nokia - Time Not Given - Expected $0.15 per share

Friday April 17th

General Electric - Before Market Open - Expected $0.21 per share

Citigroup Inc - Before Market Open - Expected -$0.36 per share

The following week may be just as big. I am really curious to see how well Google does, as they seem to be a good barometer for the tech sector in general. Their stock is up 40% from it's lows just 2 months ago.

Thursday, April 9, 2009

Next Week: Retails Sales, Philadephia Fed and More

Wow, what an end to a shortened week today. The Dow, as I type this is up over 190 points, Unemployment seems to be rising at a less rapid pace, and Wells Fargo predicted a $3 billion profit. Things really may be headed back up. I called the bottom at 6400 just a few weeks back. I am more confident then ever before that my call was correct, and those investments made back then will perform very well in the long run. Next week is a huge week for the stock market. There is all sorts of economic data being released, as well as many earnings releases too by some of the biggest companies in the US. Tomorrow The market is closed for Good Friday. I will go more into details about next weeks earnings releases sometime in tomorrow's entry. Below is a list of the key economic data we will get next week with the date and time:

- Apr 14 8:30 AM Core PPI

- Apr 14 8:30 AM PPI

- Apr 14 8:30 AM Retail Sales

- Apr 14 8:30 AM Retail Sales ex-auto

- Apr 15 8:30 AM Core CPI

- Apr 15 8:30 AM CPI

- Apr 15 8:30 AM Empire Manufacturing

- Apr 15 9:15 AM Capacity Utilization

- Apr 15 9:15 AM Industrial Production

- Apr 15 10:30 AM Crude Inventories

- Apr 15 2:00 PM Fed's Beige Book

- Apr 16 8:30 AM Building Permits

- Apr 16 8:30 AM Housing Starts

- Apr 16 8:30 AM Initial Claims

- Apr 16 10:00 AM Philadelphia Fed

- Apr 17 9:55 AM Mich Sentiment-Prel

The ones which should sway the market the most are, Retails Sales, Housing Starts, Industrial Manufacturing, and the Philadelphia fed numbers. If numbers are good as well as earnings from some of the larger companies I will discuss tomorrow, we could see the Dow in eterritor we havn't seen it in close to 6 months.

- Apr 14 8:30 AM Core PPI

- Apr 14 8:30 AM PPI

- Apr 14 8:30 AM Retail Sales

- Apr 14 8:30 AM Retail Sales ex-auto

- Apr 15 8:30 AM Core CPI

- Apr 15 8:30 AM CPI

- Apr 15 8:30 AM Empire Manufacturing

- Apr 15 9:15 AM Capacity Utilization

- Apr 15 9:15 AM Industrial Production

- Apr 15 10:30 AM Crude Inventories

- Apr 15 2:00 PM Fed's Beige Book

- Apr 16 8:30 AM Building Permits

- Apr 16 8:30 AM Housing Starts

- Apr 16 8:30 AM Initial Claims

- Apr 16 10:00 AM Philadelphia Fed

- Apr 17 9:55 AM Mich Sentiment-Prel

The ones which should sway the market the most are, Retails Sales, Housing Starts, Industrial Manufacturing, and the Philadelphia fed numbers. If numbers are good as well as earnings from some of the larger companies I will discuss tomorrow, we could see the Dow in eterritor we havn't seen it in close to 6 months.

Wednesday, April 8, 2009

Inflation: What it Means For Different Investments

While everyone in the US are worrying about the unemployment rate, whether they will have a job next week, and if their 401k's will bounce back, there is another worry behind the scenes which will not really be a problem until the economic recovery takes place. That is Inflation! Why is inflation such a big worry in the long run? Because the US and other nations have pumped trillions of dollars into the economy. When the supply of money increases, there is more of it to bid up prices of every day items. This is inflation. In the 70's and 80's we saw inflation at a rate over 10% for several years. The problem with that is the money people are holding continues to be worth less and less in relation to what it can buy. So, with the possibility of some major inflation in the future, you should know how it will effect various investments:

Inflation's Effects on Stocks

The stock market doesn't have all that much correlation to the inflation rate. If inflation goes up, companies can just raise their prices usually and make things even out. Inflation can however cause mroe volatility in the stock markets

Inflation's Effects on Money In the Bank

You don't want to have lots of money in a savings account paying low inetrest when inflation strikes. As the inflation rate rises, that money is actually losing value if your interest rate you are getting from the bank isn't at least as high as the inflation rate. The good thing though with cash is that you can usually find a bank paying a rate that is over the current inflation rate. The one tip here is to not lock any money in a CD for the long term during periods of inflation unless you feel inflation rates have peaked.

Inflation's Effects on Gold and Oil

As inflation rises commodities, especially gold and oil should rise as well. If we have high rates of inflation then Gold and Oil are where you should have at least a portion of your portfolio.

Inflations Effects on Bonds

Inflation is terrible for bonds if you already own them. As internet rates and inflation rise, the older bonds values decline since they have less a yield. On the other hand, if you can get some long term bonds while inflation is high, they will likely go uop in value when it subsides.

Inflation's Effects on Stocks

The stock market doesn't have all that much correlation to the inflation rate. If inflation goes up, companies can just raise their prices usually and make things even out. Inflation can however cause mroe volatility in the stock markets

Inflation's Effects on Money In the Bank

You don't want to have lots of money in a savings account paying low inetrest when inflation strikes. As the inflation rate rises, that money is actually losing value if your interest rate you are getting from the bank isn't at least as high as the inflation rate. The good thing though with cash is that you can usually find a bank paying a rate that is over the current inflation rate. The one tip here is to not lock any money in a CD for the long term during periods of inflation unless you feel inflation rates have peaked.

Inflation's Effects on Gold and Oil

As inflation rises commodities, especially gold and oil should rise as well. If we have high rates of inflation then Gold and Oil are where you should have at least a portion of your portfolio.

Inflations Effects on Bonds

Inflation is terrible for bonds if you already own them. As internet rates and inflation rise, the older bonds values decline since they have less a yield. On the other hand, if you can get some long term bonds while inflation is high, they will likely go uop in value when it subsides.

Tuesday, April 7, 2009

VineFire Scam? For Sure

I don't usually weigh in on these types of programs, but since Vinefire is so popular so fast, I thought I'd give my view on the program. On the cover Vinefire seems like just another Digg.com type site. You post links, and other rate them. That is until you see what this site, which likely has less then a few hundred dollars a day in revenue, offers:

VineFire's Payout Offers

So, how is VineFire a scam?

VineFire's Payout Offers

- $50.00 Just to sign up

- $0.45 for each Link your click

- $0.50 for each Sponsored link clicked (Sponsored links are Affiliate links for the owner)

- $0.12 cents to post a link

So, how is VineFire a scam?

- They waste your time

- They charge peopel for featured links

- They charge people for accoutn upgrades. $5 to raise your daily earnign limit from $50 to $100

Monday, April 6, 2009

A Sign of a Market Recovery - Acquisitions

A few weeks ago, before the Dow decided to run up close to 20% making it the biggest short term rally since the Great Depression, I stated that one of the signs of a recovery is when larger corporations begin buying up the smaller ones.

Well, it looks like the buying has begun. Google is supposedly in talks with the Social networking site Twitter.com to either buy, or make a search deal with them. If Google was to acquire Twitter it would give them an instant inroad into the live search areas. Twitter is used for people to write a short 140 character or less message describing what is on their mind, or what they are doing. Because so many people use them, it is very easy to search Twitter for a word, and see just how that word relates to current events in real time. Google could really take advantage of that kind of information.

There are also many other deals in the works. IBM was, and maybe still is trying to acquire Sun Microsystems, and the pharmaceutical industry is starting to gain buzz about all sorts of possible acquisitions and mergers. This is a sure sign that larger corporations believe that the smaller ones are currently undervalued, likely because the whole stock market as a whole is undervalued. Look for the coming months to even heat up more with deals being made in just about every industry there is. Earnings season is here, and next week Google as well as Apple and many other tech firms will be announcing earnings. It should be interesting to see what they are and what it may say about the economy in general.

Well, it looks like the buying has begun. Google is supposedly in talks with the Social networking site Twitter.com to either buy, or make a search deal with them. If Google was to acquire Twitter it would give them an instant inroad into the live search areas. Twitter is used for people to write a short 140 character or less message describing what is on their mind, or what they are doing. Because so many people use them, it is very easy to search Twitter for a word, and see just how that word relates to current events in real time. Google could really take advantage of that kind of information.

There are also many other deals in the works. IBM was, and maybe still is trying to acquire Sun Microsystems, and the pharmaceutical industry is starting to gain buzz about all sorts of possible acquisitions and mergers. This is a sure sign that larger corporations believe that the smaller ones are currently undervalued, likely because the whole stock market as a whole is undervalued. Look for the coming months to even heat up more with deals being made in just about every industry there is. Earnings season is here, and next week Google as well as Apple and many other tech firms will be announcing earnings. It should be interesting to see what they are and what it may say about the economy in general.

Friday, April 3, 2009

Crazy Facts about Forex Plus Forex Megadroid

Just wanted to go over a few things about Forex trading since it is the weekend and there isn't much economic news out. I'm just going to go over some fact that may surprise you about Forex:

- The Forex market is the largest market on the planet by far. On an every day there are over $3.5 trillion in transactions. Yes that is $3,500,000,000,000!

- Banks are estimated to have 20-30% of all their cash trading in the forex markets. It is estimated that 40% of their profits come from trading forex.

- The Forex Market has grown over 700% in the last 20 years.

- Some experts think that some banks will switch over entirely to forex trading since it has been shown to be more lucrative then that of lending. I doubt this will ever happen though.

- An individual can trade $100,000 in currency with only $1000 in cash. This is called 100:1 leverage which is allowed because of the rather tight movement of currencies.

- Unlike the stock market the forex markets are opened 24 hours a day, 7 days a week.

- There are 2 markets for demand, the traders, and the actual buyers of the currencies such as travelers and business entities.

Amazing Week on Wallstreet - Whats Next?

The Dow has been flirting and even surpassed the 8000 mark this week. Unemployment numbers were not great, but there were a lot of signs that economic conditions may be improving. At this pace the recession should probably be over by the 4th quarter, and unemployment should go down by the start of 2010. So whats on tap for Next week? Below is a quick list of the dates and times of key economic data. It really isn't that big a week in terms of data, however the following week should be packed with interesting pieces of information.

- Apr 7 2:00 PM Consumer Credit

- Apr 8 10:00 AM Wholesale Inventories

- Apr 8 10:30 AM Crude Inventories

- Apr 9 8:30 AM Export Prices ex-ag.

- Apr 9 8:30 AM Import Prices ex-oil

- Apr 9 8:30 AM Initial Claims 04/04

- Apr 9 8:30 AM Trade Balance Feb

Wholesale Inventory number should be interesting. In February it fell at a 0.7% rate, and experts expect a decrease of about 0.6% when the March number are released on Wednesday. The Initial claims of unemployment insurance should also give us an idea where Unemployment numbers are headed. A surprise to the downside, meaning more Job Opportunities for America, could keep the market rally alive and well.

- Apr 7 2:00 PM Consumer Credit

- Apr 8 10:00 AM Wholesale Inventories

- Apr 8 10:30 AM Crude Inventories

- Apr 9 8:30 AM Export Prices ex-ag.

- Apr 9 8:30 AM Import Prices ex-oil

- Apr 9 8:30 AM Initial Claims 04/04

- Apr 9 8:30 AM Trade Balance Feb

Wholesale Inventory number should be interesting. In February it fell at a 0.7% rate, and experts expect a decrease of about 0.6% when the March number are released on Wednesday. The Initial claims of unemployment insurance should also give us an idea where Unemployment numbers are headed. A surprise to the downside, meaning more Job Opportunities for America, could keep the market rally alive and well.

Thursday, April 2, 2009

Terrible Job Numbers Continue but Stocks Up

Yesterday and today we were presenting with more terrible unemployment numbers. Worse then expected by most experts in fact. US Initial Jobless Claims Rose by 12000 to 669000 last month, while people continue to get laid off while companies cut back their expenses on lessening demand for their products and services.

Why Is the Stock Market Up Then?

Despite these terrible numbers, the stock market has been up close to 5% in the last 2 days alone. Kind of ironic huh? The reason the jobs data is not affecting the stock market in a negative sense is because traders and investors have already likely priced in the expect loss of jobs. They know that the unemployment rate is a lagging indicator in the economy. This means that the Stock market, as well as economic demand will rise before the unemployment rate begins to lower and new job opportunities present themselves.

Some Good News:

The market is also being propelled by some rather optimistic news. Pending home sales were up, and the manufacturing index was not as bad as most experts thought it would be. This along with the expectations that mark-to-market accounting rules were going to be changed today has propelled especially the Banking and financial stocks.

Overall, I have a good feeling about the market. Stocks should probably settle in the 7,900-8,400 range for a while, creating a new base for a run up to higher territory in May and June.

Why Is the Stock Market Up Then?

Despite these terrible numbers, the stock market has been up close to 5% in the last 2 days alone. Kind of ironic huh? The reason the jobs data is not affecting the stock market in a negative sense is because traders and investors have already likely priced in the expect loss of jobs. They know that the unemployment rate is a lagging indicator in the economy. This means that the Stock market, as well as economic demand will rise before the unemployment rate begins to lower and new job opportunities present themselves.

Some Good News:

The market is also being propelled by some rather optimistic news. Pending home sales were up, and the manufacturing index was not as bad as most experts thought it would be. This along with the expectations that mark-to-market accounting rules were going to be changed today has propelled especially the Banking and financial stocks.

Overall, I have a good feeling about the market. Stocks should probably settle in the 7,900-8,400 range for a while, creating a new base for a run up to higher territory in May and June.

Wednesday, April 1, 2009

Google to Buy Apple - Goople

This morning Google announced in a statement that they will acquire Apple, formerly Apple Computer, in a cash and stock purchase. The deal will Give Google an instant Hardware and software business to go along with their search and cloud computer software business. As long as regulators allow the deal, Google, or Goople as it will now be called, will have a market cap of over $200 Billion.

What does this mean for Company?

The two companies mash up well. Google now has its own Cell Phone, the iPhone which is by far the leader in the smartphone industry. Along with this it will be inetresting to see what gogole does as for a smartphone operating system. They of course have their own in Android, but Apple also has their own operating system. Will they merge the two? Google now has an instant operating system to take on Microsoft. Will Goople now expand Apple OS to other computers besides the Mac? Will Goople somehow integrate iTunes into their internet search results? We will all fidn out soon I assume.

What does this Mean for Competition?

Let's just say that Microsoft has no chance. Google will lead in Internet search, smart phone sales, and have their very own computer lineup and Operating system. Windows better watch out.

What does this Mean for Consumers?

Consumers should benefit greatly from this. Innovation will be rampant. The 2 brightest tech companies are now one. I wouldn't be surprised if Goople were to subside all Iphone sales, making them extremely cheap by place ads within the phone. You shoudl see vast improvement in Googles search, when searchign for music, and a possibly faster product innovations for Apples old lineup of products.

Subscribe to:

Comments (Atom)