Friday, May 29, 2009

Next Weeks Market News Makers - Unemployment to 9.2%

It's Friday again, so that means we look at what one can expect from the markets next week. This week has been pretty good overall. We saw today that the first quarter GDP decline was only 5.7% instead of the initially thought 6.1% decline. Experts also predict a much flatter decline for the 2nd quarter and finally an increase in GDP for Quarter 3. By the forth quarter, experts predict a 1.8% increase in GDP. So what on tap for next week? Here is the economic Calendar for the first week in June, 2009:

- Jun 1 8:30 AM Personal Income

- Jun 1 8:30 AM Personal Spending

- Jun 1 10:00 AM Construction Spending

- Jun 1 10:00 AM ISM Index

- Jun 2 10:00 AM Pending Home Sales

- Jun 2 2:00 PM Auto Sales

- Jun 2 2:00 PM Truck Sales

- Jun 3 8:15 AM ADP Employment Change

- Jun 3 10:00 AM Factory Orders

- Jun 3 10:00 AM ISM Services

- Jun 3 10:30 AM Crude Inventories

- Jun 3 10:35 AM Crude Inventories

- Jun 4 8:30 AM Initial Claims 05/30

- Jun 4 8:30 AM Productivity-Rev. Q1

- Jun 4 8:30 AM Unit Labor Costs Q1

- Jun 5 8:30 AM Average Workweek

- Jun 5 8:30 AM Hourly Earnings

- Jun 5 8:30 AM Nonfarm Payrolls

- Jun 5 8:30 AM Unemployment Rate

- Jun 5 2:00 PM Consumer Credit

The data that I will be looking at that I think could move the markets quite a bit are, the construction spending data, which could signal a turnaround in the housing market, as well as the Unemployment data. The Unemployment rate was at 8.9% at the end of April, and will likely increase to about 9.2% for the end of May. Consumer credit is also another big piece of info we will get by Friday, and should let us know in a bit more detail, just how backed up the credit markets are. Another thing to note are the forex markets in which the dollar has continued to fall this week, leading Gold and other commodities to have a nice run.

Labels:

data,

economy,

money,

real estate,

unemployment

Thursday, May 28, 2009

Unemployment Rates for the Last 20 Years

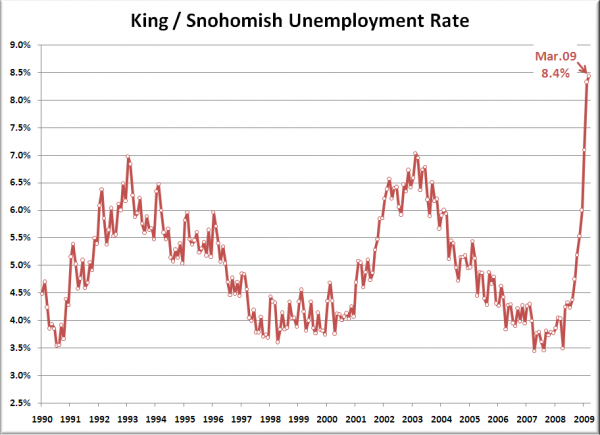

Today we got word that the the pace of Unemployment for the month decreased a bit. That's not that great news considering it still increased by more then 600,000 individuals. Anyway, On this Thursday I thought we'd have a look at the US unemployment rate for the last 20 years. I like graphs and charts, because like they say "a picture is worth a thousand words." Graphs tell multiple stories and quickly allow you to visualize just how bad things may be right now:

Looking at the chart above, which is about 45 days old, it is really daunting how fast the unemployment rate rose. Much faster then any time in the last 20 years, or last 60 years for that matter. Another thing sticks out is year and a half from 2007-2008 where the unemployment rate was under 4%. At the time we didn't realize how good we had it. Now, as the rate approaches 10%, probably sometime by the year's end, we look back just 18 months and wish we were even close to those rates. The good thing though is that we likely won't go much higher then 10%, and soon after will begin adding jobs. Will we see a rate of 3.5% like we did 2 years ago, anytime soon? I doubt it, but by late 2011 I wouldn't be surprised seeing the rate in the 5-6% range, which isn't half bad.

Wednesday, May 27, 2009

Recession over By 2nd Half of this Year

I know my blog is always pretty optimistic about the economy, so for those of you who are pessimists, you may want to skip this post. Anyway, In past entries I had predicted a bottom to the market when it hit 6400, I predicted that unemployment will begin decreasing in early 2010, and the recession would be over by the second half of this year. Well, it looks like some of the experts agree.

Recession over?

A panel of 45 of the nations leading economists, have predicted that the 2nd Quarter of this year, the one we are in now, will still see negative economic growth. However, the last 2 quarters of this year, June onward, will see positive growth from the United States economy. What does that mean? The recession's end is in sight. A full 75% of the economists polled felt the 3rd quarter of this year would see positive GDP growth. Don't get too excited though. The majority of economists polled felt that although growth will finally make it's presence, the rate of growth will be small, and well below the average growth rate of the US economy. The growth rate however will be at about average by the time 2010 rolls around.

Job Predictions

The Panel of economist's average forecasted unemployment rate by the end of 2009 is 9.8%. This is quite a high number, but in 18 months, by the end of 2010, this rate will have dropped to 9.3% and continue falling at a faster pace thereafter for several years. Unemployment is a lagging indicator, so it will usually turn around about 6 months after the general economy. This puts the turnaround somewhere around January or February of 2010.

The Real Estate Market.

Out of the 45 panelist polled, 33 thought that the housing market will bottom in the next month or 2. The negative news is that Home prices will remain at a depressed level for at east another couple years, most experts believe.

Overall however, the economy looks to be getting stronger. The doom and gloom predictions are dying out, and a more optimistic view, like mine are taking hold. How do we know people are becoming more optimistic? The consumer confidence indicator jumped 14 points in the last month.

Tuesday, May 26, 2009

North Koreas Effect on the Economy

North Korea has been in the news quite a bit over this extended Holiday weekend here in the United States. Not only did they conduct an underground nuclear test over the weekend, but last evening they test fired 3 short range missiles, after the strong condemnation of the nuclear test by the world governments. So, What kind of economic impact will this have if any if things do continue to spin out of control, which probably won't happen?

Short Term the Dollar Will Rise, Gold will Rise in relation to other Currencies - The dollar is a safe haven when there are times of uncertainty in the rest of the world. Gold also is a great place to keep your money in uncertain political times, but the rise of the dollar may make Gold's rise a little less significant for us Americans.

Long Term The Dollar will Fall - If this thing gets drug out to where military action on our part was required, this means that there would be even more massive government spending, leading to even more national debt. Debt causes the dollar's power to decline in the long run

Stock Market

In my opinion this whole mess may give us all more time to invest at low prices. I highly doubt this will turn into an all out war, but even if it does, government spending is usually a plus for stock prices. If it doesn't progress much further, then stock prices remain depressed for a few extra weeks, and then shoot back up to where they would have been without a North Korea problem on our hands.

Conclusion:

Overall, I'd recommend not changing your investing strategy at all if you are investing in US securities. If you are an Japanese, or South Korean investing in their local markets, however, an investment strategy shift may be in order.

Friday, May 22, 2009

The Economic Week in Review

Whelp, it's Friday Again, and that means it's time for the weekly recap, and look ahead for next week. This week wasn't all that great. Economic data sort of put things into perspective. The economy is still in terrible shape, but things do look like they are improving somewhat. People who lost there jobs in the last few months are not finding new work, even though the number of newly unemployed people filing claims are shrinking. I think we will see an Unemployment rate of 10% by Late July or early August. One of the problems complicating matters for the unemployed is that most companies are not offering any type of compensation plan, leaving the unemployed extremely vulnerable The housing data also was not all that great. Foreclosures continue to rise, driving the market values down dramatically in many locations across the country.

So, what can we expect next week? There will certainly be some interesting data put out. Below is a list of the economic data to be released next week along with the date and time:

- May 26 9:00 AM S&P/CaseShiller Home Price Index

- May 26 10:00 AM Consumer Confidence

- May 27 10:00 AM Existing Home Sales

- May 27 10:30 AM Crude Inventories

- May 28 8:30 AM Durable Goods Orders

- May 28 8:30 AM Durables, Ex-Transport

- May 28 8:30 AM Initial Claims

- May 28 10:00 AM New Home Sales

- May 28 11:00 AM Crude Inventories

- May 29 8:30 AM GDP - Prelim. Q1

- May 29 8:30 AM GDP Deflator Q1

- May 29 9:45 AM Chicago PMI May

- May 29 9:55 AM Mich Sentiment-Rev

I will be paying close attention on the 29th to see what the Preliminary GDP numbers look like. Those numbers could really move the markets in one direction or the other. As for Stock's Earnings reports, there are not too many major companies reporting next week. We are sort of in the dead season in terms of earnings.

Thursday, May 21, 2009

My General Negative Opinion on MLM's

I did a piece a few weeks back about ebooks, and how you can never really get a true review about them before ordering one from Clickbank, or any of the other ebook distributors out there. I wasn't talking about the new ebook generation of Amazon Kindles which read novels, but the first generation ebook industry which were mostly informational and learning products. Anyway, what's worse than ebooks in terms of rabid promoters, and pushers of the products are MLM's!

The Problem with MLM's

MLM's or Multi Level marketing programs are companies that allow anyone to become a distributor. Usually though, you have to pay a startup fee, or at the very least be a client yourself in order to sell. One recent MLM is the Monavie Acai Berry health drink. I won't even begin to get into what I think about Monavie, but will say that it is the perfect example of a MLM which clouds the availability of unbiased reviews. Just do a simple search for "Monavie Review" in Google, and then try to find one that is unbiased, one that is not rewritten by someone who is a distributor for the company. I am almost certain that you won't find a real review, by a real customer anywhere on the 1st, 2nd, 3rd, 4th, or even 5th page of Google's results. Many of the reviews may be written as if they are from an unbiased client, however, that's just a marketing ploy in order to sell more Monvie.

Lesson Learned

Basically what I'm ranting about is that you can not always use the internet, or even supposed friends for a review of a product, especially if those consumers of the product are also sellers. Be careful, and be cautious, as there are a lot of manipulative people out there, some even your friends. Money speaks louder then the truth sometimes.

Wednesday, May 20, 2009

Donald Trump Entering the MLM Industry - Trump Network

Over the 10 years or so that I have been marketing online, I have come across all sorts of compensation plans. I've usually stayed away from MLM's (Multi Level Marketing Programs) due to the fact that I felt they were a bit scammy, as well as having products that don't usually benefit the consumer, but instead benefiting the thousands of promoters of the MLM itself.

My View towards Multi-Level marketing programs may soon change though. Donald Trump has recently announced that he will in fact be launching his very own MLM in October of 2009. You don't have to wait that long to get some of the specifics of the program though. The Trump Network will have a prelaunch where you can begin signing up to become a sales rep sometime in July of this year. The MLM will be structured around the sale of vitamins that are customized to each individual. Trump Purchased the company Ideal Health a few years back and will be using it as the backbone of the Trump Network.

Here is a short Quote from Donald Trump Himself to begin the Trump Network brochure:

America is at a crossroads.

At no time in recent history has our economy been in the state that it is today.

We’re in the midst of an economic meltdown created by Wall Street greed, financial industry ineptitude, and a multi-billion dollar government bail out of the financial system that isn’t working. The American dream has been hijacked by complacency and incompetence. My experience in real estate has taught me that the greatest opportunities exist when economic times are at their worst. That’s why, after the real estate crash of the ‘90s, I came back stronger than ever. The first thing I learned is that when times are tough, you need to hedge your bets—you need to diversify.

I'd love to hear your feedback on this company, and if you think the Trump Network will become a $1 billion + company like Donald himself claims it will.

Tuesday, May 19, 2009

$20.00 - Retweet This Post and win Cash Twitter

I thought I would reward some of the people who read this blog on a regular basis. Considering the economy is in bad shape, everyone can use an extra $20 in cash, right? That's why I decided to do this simple Little exercise for those of you who wish to participate and win $20 in Paypal cash:

Here are the simple Rules to this Twitter Cash Giveaway:

#1 Simply Click the "retweet" button at the top of this post to retweet this blog post

#2 Once done, comment on this post with your Twitter ID

#3 Than pay a visit to our sponsors site: Talkgold

#4 At Midnight eastern time tonight May 19th, one person will be choosen at random from the blog comments and be announced within this post, with instructions on how to claim the $20 cash.

Also remember to follow us on twitter at: http://twitter.com/edbri871

If this goes well we will give away cash every week.

Monday, May 18, 2009

The Best Smart Grid Stocks

Many Americans probably heard the term "Smart Grid" before, but very few know exactly what it is. Basically the smart grid is a newly designed and eventually implemented electricity grid in the United States that will allow a more technologically advanced system of electricity distribution. It will allow individuals to save money by saving on their energy consumption, and increase the reliability and safety of the electricity distribution. With the smart grid, power is no longer centralized, and instead can be stored all over the grid itself.

So there are 2 ways to play such stocks. You can look at the smaller cap stocks which will play a larger role in the creation of the grid, or you can play the larger cap, well known stocks which are going to benefit greatly from the grid deployment, but don't have a business that is totally enveloped within the Grid's success or failure. Here are a couple of each:

Smaller Companies:

Itron, Inc (ITRI) - provides a portfolio of products and services to utilities for the energy and water markets throughout the world. The Company is a provider of metering, data collection and software, which can alert people to their energy consumption changes. Itron has two business segments: Itron North America and Actaris.

ComVerge (COMV) - Comverge, Inc. is a clean energy company providing demand management solutions in the form of peaking and base load capacity to electric utilities, grid operators and associated electricity markets.

Echelon Corporation (ELON) - Echelon Corporation develops, markets, and sells system and network infrastructure products that enable various devices, such as air conditioners, appliances, electricity meters, light switches, thermostats, and valves to be made smart and inter-connected.

Larger Caps:

Cisco (CSCO) - Cisco is known for it's internet router and network business. They predict the smart grid could be worth up to $20 billion a year for 5 years for their industry.

Intel (INTC) - Intel is the world largest computer chip maker. Any grid technology out there will without a doubt need smart, innovative new computer ships in mass quantity.

Investing in these smart grid companies as well as others may not give you instant returns, but if your time horizon is 4-7 years or so, they should pay off nicely. I recommend diversifying among them all.

So there are 2 ways to play such stocks. You can look at the smaller cap stocks which will play a larger role in the creation of the grid, or you can play the larger cap, well known stocks which are going to benefit greatly from the grid deployment, but don't have a business that is totally enveloped within the Grid's success or failure. Here are a couple of each:

Smaller Companies:

Itron, Inc (ITRI) - provides a portfolio of products and services to utilities for the energy and water markets throughout the world. The Company is a provider of metering, data collection and software, which can alert people to their energy consumption changes. Itron has two business segments: Itron North America and Actaris.

ComVerge (COMV) - Comverge, Inc. is a clean energy company providing demand management solutions in the form of peaking and base load capacity to electric utilities, grid operators and associated electricity markets.

Echelon Corporation (ELON) - Echelon Corporation develops, markets, and sells system and network infrastructure products that enable various devices, such as air conditioners, appliances, electricity meters, light switches, thermostats, and valves to be made smart and inter-connected.

Larger Caps:

Cisco (CSCO) - Cisco is known for it's internet router and network business. They predict the smart grid could be worth up to $20 billion a year for 5 years for their industry.

Intel (INTC) - Intel is the world largest computer chip maker. Any grid technology out there will without a doubt need smart, innovative new computer ships in mass quantity.

Investing in these smart grid companies as well as others may not give you instant returns, but if your time horizon is 4-7 years or so, they should pay off nicely. I recommend diversifying among them all.

Friday, May 15, 2009

Economic Data Calendar - Next Week

As always, on Friday morning I look over my portfolio and evaluate things. This weeks wasn't so great, but like most weeks, there aren't many changes I'd like to make. I did up my holdings in BGU which is the ETF for 3X Long Large Cap Stocks. It may fluctuate greatly over the next couple months, but in the long run it will pay off 3 times as much as the overall market. That is of course if there is not a 2700 point drop in the dow, which could be quite risky for this ETF. The next thing I do after evaluating my portfolio is I look at what is to come next week. Next week is probably going to be rather uninteresting on a macro level, however there are some pretty important companies reporting earnings. Here is the Economic Data Calendar for Next week:

- May 19 8:30 AM Building Permits

- May 19 8:30 AM Housing Starts

- May 20 10:30 AM Crude Inventories-

- May 20 10:35 AM Crude Inventories

- May 20 2:00 PM FOMC Minutes

- May 21 8:30 AM Initial Claims

- May 21 10:00 AM Leading Indicators

- May 21 10:00 AM Philadelphia Fed

Tuesday's Housing starts and Building Permits data should be inetresting, and has the potential to move the markets. What abotu Earnings? Here are some of the companies reporting next week:

Dick's Sporting Goods, Inc. - Tuesday

Hewlett-Packard - Tuesday

Home Depot Inc - Tuesday

Vodafone Group PLC - Tuesday

BJ's Wholesale Club - Wednesday

PetSmart - Wednesday

Target Ibnc - Wednesday

Aeropostale, Inc. - Thursday

Barnes and Noble - Thursday

Salesforce.com, Inc. - Thursday

British Airways - Friday

- May 19 8:30 AM Building Permits

- May 19 8:30 AM Housing Starts

- May 20 10:30 AM Crude Inventories-

- May 20 10:35 AM Crude Inventories

- May 20 2:00 PM FOMC Minutes

- May 21 8:30 AM Initial Claims

- May 21 10:00 AM Leading Indicators

- May 21 10:00 AM Philadelphia Fed

Tuesday's Housing starts and Building Permits data should be inetresting, and has the potential to move the markets. What abotu Earnings? Here are some of the companies reporting next week:

Dick's Sporting Goods, Inc. - Tuesday

Hewlett-Packard - Tuesday

Home Depot Inc - Tuesday

Vodafone Group PLC - Tuesday

BJ's Wholesale Club - Wednesday

PetSmart - Wednesday

Target Ibnc - Wednesday

Aeropostale, Inc. - Thursday

Barnes and Noble - Thursday

Salesforce.com, Inc. - Thursday

British Airways - Friday

Thursday, May 14, 2009

5 Ways to Build Back Your Wealth

So your 401k plans are at levels unimaginable, your home value is probably between 50-80% of what it was just a couple years ago, and you may have either lost your job, or are on shaky ground at work. Don't fret, I'm hear to provide you a few tips on how to rebuild some of your wealth so that next time the economy crashes, you are in a much better situation. Things seem bad now, but they will get better, and in the end you will have learned a great deal about your finances. Here are 5 ways to build your wealth back up.

- Build your Credit Score - In times of crisis it's always good to have a nice credit line with a low interest rate in case of an unforeseen emergency. Build your credit score, by lowering your debt to credit ratio. This means you need to pay off the debt you owe, while also trying to get a credit line increase. The more credit you have available, that you do not use, the higher your score will usually be in the long run.

- Don't watch so much TV - Did you know that for every 1 hour of television you watch per week, your expenditures increase by $200 for the year? The reason for this is that we are influenced by trends on tv. If our favorite athlete or movie star is wearing a certain piece of clothing, driving a certain car in a sitcom, we are more likely to want that object.

- Reevaluate your Portfolio - This is a great time to re-adjust our investment holdings. If you are in the age range where you should have a 50% stock holding and 50% bond holding, it is likely that after the recent crash, things are not 50/50 any longer. This probably means you should buy more stocks. In the long run it will even out and you will likely recover your losses

- Reevaluate your Car and Homeowners Insurance Policies - Did you know that you could save about $400 a year if you raise your deductible for homeowners insurance from $500 to $5000? That may seem like a big step, but in actuality, how often have you had to put a claim in? Insurance should be there to protect from catastrophy, not the minor problems.

- Refinance - This is probably one of the most overlooked ways to save a bundle of money. Did you knwo that if you were to refinance your $300,000 mortgage from a 6% rate to 5% rate, you'd save over $40,000 during the life of the loan? You'd also cut your monthly payment by abotu $350 as well. $350 a month is a nice amoutn fo money you could be saving isn;t it?

Tuesday, May 12, 2009

More Good News for the Economy

It seems as though the economic good news keeps coming one news story at a time. Here are just a few of the bright economic news stories that I have read about in the last 24 hours:

#1 Alan Greenspan see the Housing Market Bottoming, and said that it is “very easy to see” the financial markets improving. Remember, one of the main things we need to look at to determine when the recession may end is the supply of homes on the market and how low the prices are going. Although this month has seen some pretty large price declines, we are also seeing demand for homes pick up quite a bit. As banks get rid of the homes under water via short sales and foreclosures, prices will typically drop, but what matters that they are selling.

#2 Intel Chief sees Chip sales higher then expected. Computer chip sales are selling better then most experts had predicted. This may mean that the tech sector isn't really doing all that bad after all.

#3 Top Officials talking about the Fed Raising Rates. In order to prevent inflation, which I discussed in Yesterdays post, The Fed is already talking about how soon it will be before they raise rates. Just the fact that they are considering raising rates means that they feel things are getting more stable.

As I finish writing this the market is down quite a bit. Wait to see where it seems to land and then I will be taking this as yet another buying opportunity.

#1 Alan Greenspan see the Housing Market Bottoming, and said that it is “very easy to see” the financial markets improving. Remember, one of the main things we need to look at to determine when the recession may end is the supply of homes on the market and how low the prices are going. Although this month has seen some pretty large price declines, we are also seeing demand for homes pick up quite a bit. As banks get rid of the homes under water via short sales and foreclosures, prices will typically drop, but what matters that they are selling.

#2 Intel Chief sees Chip sales higher then expected. Computer chip sales are selling better then most experts had predicted. This may mean that the tech sector isn't really doing all that bad after all.

#3 Top Officials talking about the Fed Raising Rates. In order to prevent inflation, which I discussed in Yesterdays post, The Fed is already talking about how soon it will be before they raise rates. Just the fact that they are considering raising rates means that they feel things are getting more stable.

As I finish writing this the market is down quite a bit. Wait to see where it seems to land and then I will be taking this as yet another buying opportunity.

Inflation over the Years - Why It Won't Sky Rocket Now

I like looking at graphs of data from years past. I was doing a report on Inflation the other day and came by a really easy to read inflation graph for each year from 1911-2006. It will give you a clear picture of how the US inflation rate has changed over the last 95 years or so.

What can we immediately notice here?

Inflation has remained relatively stable, with very little volatility in the last 27 years. Since 1982 the inflation rate has bounced back and forth between about 2% and 5.5%. This is a very tight enclosure. The primary reason for the very unvolatile rate is that the Federal Reserve now has a really good handle on monetary policy, and the other tools at hand. Many economic experts, and even myself have made the case for a significant rise in the inflation rate, but after I have read several articles on the history of inflation, I seem to question my past predictions.

Will Inflation rise?

Yes it will, but I don't think ti will be as much a problem as I had previously thought. Although the Oil shortage of the late 70's caused the rate to skyrocket, the Federal reserve has learned a lot, and has more tools at it's disposal then they did just 30 years ago. I don't think we will see inflation over 7% or so in the long run, and i think that may be too high. The economy will recover, and there will be a huge supply of money, however, the Fed will increase interest rates. and likely bring inflation under control quite quickly. I'm not saying you should go out and buy bonds right now, or sell your Gold or Silver, but I am saying that I don't think things will be as serious as some are making them out to be.

Monday, May 11, 2009

Google Finance has new Layout and Features

Whenever I am considering buying or selling a stock, ETF, or mutual fund, I do quite a bit of research first. The main 2 sites I use for my personal research are Google Finance and Yahoo Finance. They both had their positives and negatives, and if used together, in my opinion, made the perfect research vehicle.

Today when I woke up, I found that Google has redone it's finance page. At first it took me a few minutes to adjust to the new layout, and understand some of the new features they offer, but overall I think this will probably weigh in favor of Google over Yahoo. Here are some of the things that Google has changed about their finance site:

Today when I woke up, I found that Google has redone it's finance page. At first it took me a few minutes to adjust to the new layout, and understand some of the new features they offer, but overall I think this will probably weigh in favor of Google over Yahoo. Here are some of the things that Google has changed about their finance site:

- The main page is now more streamlined. All the news is in the center in a straight line configuration. Now they show both the market news and your portfolio news under that, instead of using tabs to have to change between the two. On the left side bar lists the stocks you have recently looked up, and on the right your portfolio. There is also a mroe prominant link to the Google Stock screener which I find an amazing tool.

- Each individual stock page is now layed out differently. The navigational links as well as your last view stocks are still on the left sidebar, while on the right hand sidebar at top is a mini graph showing what the stock, it's setor, the DOW and NASDAQ have doen for the day. The layout also makes it easier to use the technical graphs that I love, which Google provides for free.

Friday, May 8, 2009

Another Great Week on WallStreet

This has been yet another great week for investors on Wallstreet. The markets are all up, we are past the 8,500 mark, and economic data continues to be relatively positive. We are a far cry away from the lows of 6400 we hit back in Early March. In Fact if you invested in the Dow Back then, you would already be up over 25%. As long as the economic data doesn't point to a recession lasting into 2010, I think we could see continued gains in the mid term. There will be pull backs as will all rallies, but the overall trend should remain up. Next week is another week filled with some key economic data. Below is a list of some of the more important information coming out that may help direct the markets in the second week of May:

- May 12 8:30 AM Trade Balance

- May 12 2:00 PM Treasury Budget

- May 13 8:30 AM Export Prices

- May 13 8:30 AM Import Prices ex-oil

- May 13 8:30 AM Retail Sales

- May 13 8:30 AM Retail Sales ex-auto

- May 13 10:00 AM Business Inventories

- May 13 10:30 AM Crude Inventories

- May 13 10:35 AM Crude Inventories

- May 14 8:30 AM Core PPI

- May 14 8:30 AM Initial Claims

- May 14 8:30 AM PPI

- May 15 8:30 AM Core CPI

- May 15 8:30 AM CPI

- May 15 8:30 AM Empire Manufacturing

- May 15 9:00 AM Net Long-Term TIC Flows

- May 15 9:15 AM Capacity Utilization

- May 15 9:15 AM Industrial Production

- May 15 9:55 AM Mich Sentiment-Prel

The Data I will be following closely are the Imports/Exports, Trade Balance, Retail Sales, Producer Price Index, and Intial Claims of Unemployment. As long as these numbers don't fall in the "shockingly bad" category I think that Wallstreet investors should dress for success, as the markets should remain rather stable next week.

- May 12 8:30 AM Trade Balance

- May 12 2:00 PM Treasury Budget

- May 13 8:30 AM Export Prices

- May 13 8:30 AM Import Prices ex-oil

- May 13 8:30 AM Retail Sales

- May 13 8:30 AM Retail Sales ex-auto

- May 13 10:00 AM Business Inventories

- May 13 10:30 AM Crude Inventories

- May 13 10:35 AM Crude Inventories

- May 14 8:30 AM Core PPI

- May 14 8:30 AM Initial Claims

- May 14 8:30 AM PPI

- May 15 8:30 AM Core CPI

- May 15 8:30 AM CPI

- May 15 8:30 AM Empire Manufacturing

- May 15 9:00 AM Net Long-Term TIC Flows

- May 15 9:15 AM Capacity Utilization

- May 15 9:15 AM Industrial Production

- May 15 9:55 AM Mich Sentiment-Prel

The Data I will be following closely are the Imports/Exports, Trade Balance, Retail Sales, Producer Price Index, and Intial Claims of Unemployment. As long as these numbers don't fall in the "shockingly bad" category I think that Wallstreet investors should dress for success, as the markets should remain rather stable next week.

Thursday, May 7, 2009

US Economy is Recovering

Another Week, another climb for US Stocks. I thought since I missed my usual Wednesday post, I will make up for it by doing an overview of some of the Good News we have all received this week, which Points to a recovery sometime this year in the economy, and the stock markets:

#1 Bank Stress Tests

The stress tests seem to be showing positive signs. None of the 19 banks who participated in the tests have been found to be insolvent. Because of this Bank stocks have sky rocketed this week.

#2 Unemployment Rate Easing

The number of people filing first-time unemployment claims fell by 34,000 this week alone. Although more people are still filing for unemployment, then are getting jobs, by quite a wide margin, the fact that the rate of job declines is falling is a signal of a trend change.

#3 Corporate Outlooks Becoming Rosier

Companies like Macy's, Cisco, Walmart, and other are giving outlooks which are much rosier then most people were expecting. This shows that they have information that supports a soon ending recession.

It is looking more and more likely that the worse recession in decades may just end before we hit a new decade. Fall of 2009 should see some growth in the economy in my opinion.

#1 Bank Stress Tests

The stress tests seem to be showing positive signs. None of the 19 banks who participated in the tests have been found to be insolvent. Because of this Bank stocks have sky rocketed this week.

#2 Unemployment Rate Easing

The number of people filing first-time unemployment claims fell by 34,000 this week alone. Although more people are still filing for unemployment, then are getting jobs, by quite a wide margin, the fact that the rate of job declines is falling is a signal of a trend change.

#3 Corporate Outlooks Becoming Rosier

Companies like Macy's, Cisco, Walmart, and other are giving outlooks which are much rosier then most people were expecting. This shows that they have information that supports a soon ending recession.

It is looking more and more likely that the worse recession in decades may just end before we hit a new decade. Fall of 2009 should see some growth in the economy in my opinion.

Tuesday, May 5, 2009

Sell in May Go Away - False

There has been this saying among both stock traders and investors alike that goes like this. "Sell in May, Go away." Basically these 5 words mean one thing. Sell your stocks in May, and don't look back until much later in the year. Traders for some reason think that overall its best to sell off everything right before summer, and come back in mid fall to buy it all back on the cheap. Although long term trends may point to this, I would say this is an extremely broad and very risky philosophy especially in todays markets which are already down over 40% from their peaks.

I thought I'd explore the last few years and see what would happen if one were to sell the Dow in May, and then buy it back in October.

Dow May 9th, 2008 - 12,745

Dow October 10th - 8,451 (Note that this was about when Lehman failed)

(Sell in May Go away is accurate)

Dow May 11th, 2007 - 13,336

Dow October 12th - 14,093

(Sell In May Go Away loses money)

Dow May 12, 2006 - 11,380

Dow October 13th - 11,960

(Sell In May Go Away loses money)

Dow May 13th, 2005 - 10,140

Dow October 13th - 10,287

(Sell In May Go Away loses money)

Dow May 14th, 2004 - 10,012

Dow October 15th - 9,933

(Sell in May Go away is accurate)

So, if you go back the last 5 years, It is pretty even. I would say that from recent data, don't make any rash decisions based on a simple trader saying.

I thought I'd explore the last few years and see what would happen if one were to sell the Dow in May, and then buy it back in October.

Dow May 9th, 2008 - 12,745

Dow October 10th - 8,451 (Note that this was about when Lehman failed)

(Sell in May Go away is accurate)

Dow May 11th, 2007 - 13,336

Dow October 12th - 14,093

(Sell In May Go Away loses money)

Dow May 12, 2006 - 11,380

Dow October 13th - 11,960

(Sell In May Go Away loses money)

Dow May 13th, 2005 - 10,140

Dow October 13th - 10,287

(Sell In May Go Away loses money)

Dow May 14th, 2004 - 10,012

Dow October 15th - 9,933

(Sell in May Go away is accurate)

So, if you go back the last 5 years, It is pretty even. I would say that from recent data, don't make any rash decisions based on a simple trader saying.

Monday, May 4, 2009

How To Make Money with ETFs If you Have Patience

Earlier I gave a list of some of my favorite ETF's. ETF's for those who don't know are Exchange traded funds which trade just like stocks on the New York Stock Exchange. The great thing about many ETFs is they allow you to leverage up to 3 times. This is great for day traders because it multiplies the volatility by three as well, allowing them to make quick swing trades several times during the day.

I want to argue that many of these 3 Times Leveraged ETFs will make solid short to mid term investments for those of you who have some minor risk tolerance as well as the patience both financially and mentally to deal with the ups and downs before cashing in. This is my arguement as well as some investments I'd recommend if you are feeling a bit riskier:

We all know that eventually the stock market will go back up from where it came from. This has been the case numerous times over the last 100 years and surely will be the case again. Once the economy shows that it is on solid ground, instead of the Dow being 8000 or so, it will start going back towards, 10,000, 12,000, 14,000 or higher. it may take a few years, but almost any economist will agree that it will occur. Now, what if you had the patience to wait that long, and could leverage your money by three times. This means that if you have $100,000 to invest, you can leverage it so that you can buy $300,000 worth of stocks. In effect this is exactly what the 3X ETF's allow you to do. My favorites are: (BGU) - 3X Long Large Caps, and (TNA) - 3X Long Small Caps. Basically this says that if you invest into either of these ETFS, when the large cap and small cap indexes go up 20% the ETF will rise #X's that, or 60%.

Now, think about this. The Dow is currently hovering around 8000. When it jumps back up to 12,000, say in 2 years or so (maybe sooner, maybe later) that equates to a 50% gain. If you invest into the above ETFs, you would be getting a 150% Gain instead. That means instead of turning your $100,000 into $150,000, you would turn it into $250,000. Hey thats not bad for a 2 year investment possibly. Having said this, you have to remember if the market goes down further you are goign to lose 3 times as much money if you sell.

I want to argue that many of these 3 Times Leveraged ETFs will make solid short to mid term investments for those of you who have some minor risk tolerance as well as the patience both financially and mentally to deal with the ups and downs before cashing in. This is my arguement as well as some investments I'd recommend if you are feeling a bit riskier:

We all know that eventually the stock market will go back up from where it came from. This has been the case numerous times over the last 100 years and surely will be the case again. Once the economy shows that it is on solid ground, instead of the Dow being 8000 or so, it will start going back towards, 10,000, 12,000, 14,000 or higher. it may take a few years, but almost any economist will agree that it will occur. Now, what if you had the patience to wait that long, and could leverage your money by three times. This means that if you have $100,000 to invest, you can leverage it so that you can buy $300,000 worth of stocks. In effect this is exactly what the 3X ETF's allow you to do. My favorites are: (BGU) - 3X Long Large Caps, and (TNA) - 3X Long Small Caps. Basically this says that if you invest into either of these ETFS, when the large cap and small cap indexes go up 20% the ETF will rise #X's that, or 60%.

Now, think about this. The Dow is currently hovering around 8000. When it jumps back up to 12,000, say in 2 years or so (maybe sooner, maybe later) that equates to a 50% gain. If you invest into the above ETFs, you would be getting a 150% Gain instead. That means instead of turning your $100,000 into $150,000, you would turn it into $250,000. Hey thats not bad for a 2 year investment possibly. Having said this, you have to remember if the market goes down further you are goign to lose 3 times as much money if you sell.

Subscribe to:

Comments (Atom)