Stocks this morning are lower after a brief gain at the market open. There are 2 main pieces of News this morning, from the economic front. Like I said, this week was going to be packed with news since it's the end of the month as well as the end of the 1st half of 2009.

Consumer Confidence in June Falls

After 2 months of gains in the consumer confidence data, we have seen a drop for the month of June. Consumers attitudes towards the current economic environment dropped to 49.3 from 54.8 in May. Not a huge drop, but still something to note. The overall point here is that the economy is still very weak, but not close to as weak as it was just 4-6 months ago.

Home Prices Dropping, But at Slower Pace

Even though home prices across the nation have dropped once again from March to April, the drop was very mild. Prices on a whole, in the 20 city S&P/Case-Shiller Home Price index fell just 0.6% in that given month. On the other hand, the Year over year drop is quite staggering, yet expected, at 18% from April 2008 - April 2009. "While one month's data cannot determine if a turnaround has begun, it seems that some stabilization may be appearing in some of the regions," said David Blitzer, Chairman of the Index Committee at Standard & Poor's. "We are entering the seasonally strong period in the housing market, so it will take some time to determine if a recovery is really here."

Overall, things were pretty much what most economist expected. We are recovering, but the recovery will not be over night, and will be slow, with a few potholes in the road. Remember, Tomorrow starts the 3rd quarter of 2009 already, and that's when many economist, as well as myself think the recession will be officially over.

Tuesday, June 30, 2009

Monday, June 29, 2009

How to Save Money on Your Auto Loan

With the economy still hurting, and people without work, buying a new car is often way in the back of your mind. Having said this, there are many great deals out there, as the auto makers try to recover from bankruptcy, and get rid of the cars which are left over from the hundreds of closed dealerships around the country. If you are looking to buy a new or used vehicle, there probably is not a better time than today. Here are a 4 ways to save money on your Auto loan and car purchase, and make sure the loan is as affordable as possible:

#1 Pay as much money as you can in cash. The larger the down payment, the smaller your monthly payments will be. Often times if you put a large down payment down, you can shorten the length of the loan, thus also reducing the interest rate quite significantly.

#2 Pay close attention to both the price you would pay in normal circumstances, and that which you would pay with a low rate loan. Often times you will not be eligible for the many discounts provided by the dealership and car company should you opt for the low rate loan special.

#3 Shop around for a bank loan, before even considering getting financing from the dealership. Finance charges add up, and often times you will pay several hundred dollars more with the dealership financing option.

#4 You Are in Control. Go into the dealership, tell them the exact price you are willing to pay, and don't budge. Let them know you are not going to budge, and that you would rather forget about buying the vehicle altogether than pay even one more cent. Time are tough for car companies. Dealers have lots of room to bargain with.

Remember to do your homework, checking out the current rates available, as well as the average sale price of the vehicle you are interest in. When you go into the dealership, you want them to know that you are in control, and are just as knowledgeable as they are.

#1 Pay as much money as you can in cash. The larger the down payment, the smaller your monthly payments will be. Often times if you put a large down payment down, you can shorten the length of the loan, thus also reducing the interest rate quite significantly.

#2 Pay close attention to both the price you would pay in normal circumstances, and that which you would pay with a low rate loan. Often times you will not be eligible for the many discounts provided by the dealership and car company should you opt for the low rate loan special.

#3 Shop around for a bank loan, before even considering getting financing from the dealership. Finance charges add up, and often times you will pay several hundred dollars more with the dealership financing option.

#4 You Are in Control. Go into the dealership, tell them the exact price you are willing to pay, and don't budge. Let them know you are not going to budge, and that you would rather forget about buying the vehicle altogether than pay even one more cent. Time are tough for car companies. Dealers have lots of room to bargain with.

Remember to do your homework, checking out the current rates available, as well as the average sale price of the vehicle you are interest in. When you go into the dealership, you want them to know that you are in control, and are just as knowledgeable as they are.

Labels:

auto loans,

credit cards,

credit loans,

dealership,

make money,

purchase,

vehicle

Friday, June 26, 2009

Consumer Spending Rises

This has been a rather action packed week. We got word from the FED on interest rates, we had Ben Bernanke grilled by law makers, and we got some rather interesting economic data released.

Today in fact we got more information pointing to the economic rebound most economists were hoping for. Consumer spending increased 0.3% for the month of May, after a revised, flat April. Since Consumer spending makes up about 70% of the economy, this is certainly a sign that we are likely pulling out of the recession.

Anyway, here is the list of economic data we will get next week. It should be a pretty telling week, as a lot of data will be out at the end of this month.

- Jun 30 9:00 AM Consumer Confidence Jun

- Jun 30 9:00 AM S&P/Case-Shiller Home Price Index Apr

- Jun 30 9:00 AM S&P/CaseShiller Home Price Index Apr

- Jun 30 9:45 AM Chicago PMI Jun

- Jul 1 8:15 AM ADP Employment Change Jun

- Jul 1 10:00 AM Construction Spending May

- Jul 1 10:00 AM ISM Index Jun

- Jul 1 10:00 AM Pending Home Sales May

- Jul 1 10:30 AM Crude Inventories 06/26

- Jul 1 2:00 PM Auto Sales Jun

- Jul 1 2:00 PM Truck Sales Jun

- Jul 2 8:30 AM Average Workweek Jun

- Jul 2 8:30 AM Hourly Earnings Jun

- Jul 2 8:30 AM Initial Claims 06/27

- Jul 2 8:30 AM Nonfarm Payrolls Jun

- Jul 2 8:30 AM Unemployment Rate Jun

- Jul 2 8:30 AM Unemployment Rate Jun

- Jul 2 8:30 AM Hourly Earnings Jun

- Jul 2 8:30 AM Average Workweek Jun

- Jul 2 8:30 AM Initial Claims 06/27

- Jul 2 10:00 AM Factory Orders

I will be looking at the unemployment rate, initial Claims of Unemployment, and the Auto sales numbers carefully next week for more info on how much better the economy may be improving.

Today in fact we got more information pointing to the economic rebound most economists were hoping for. Consumer spending increased 0.3% for the month of May, after a revised, flat April. Since Consumer spending makes up about 70% of the economy, this is certainly a sign that we are likely pulling out of the recession.

Anyway, here is the list of economic data we will get next week. It should be a pretty telling week, as a lot of data will be out at the end of this month.

- Jun 30 9:00 AM Consumer Confidence Jun

- Jun 30 9:00 AM S&P/Case-Shiller Home Price Index Apr

- Jun 30 9:00 AM S&P/CaseShiller Home Price Index Apr

- Jun 30 9:45 AM Chicago PMI Jun

- Jul 1 8:15 AM ADP Employment Change Jun

- Jul 1 10:00 AM Construction Spending May

- Jul 1 10:00 AM ISM Index Jun

- Jul 1 10:00 AM Pending Home Sales May

- Jul 1 10:30 AM Crude Inventories 06/26

- Jul 1 2:00 PM Auto Sales Jun

- Jul 1 2:00 PM Truck Sales Jun

- Jul 2 8:30 AM Average Workweek Jun

- Jul 2 8:30 AM Hourly Earnings Jun

- Jul 2 8:30 AM Initial Claims 06/27

- Jul 2 8:30 AM Nonfarm Payrolls Jun

- Jul 2 8:30 AM Unemployment Rate Jun

- Jul 2 8:30 AM Unemployment Rate Jun

- Jul 2 8:30 AM Hourly Earnings Jun

- Jul 2 8:30 AM Average Workweek Jun

- Jul 2 8:30 AM Initial Claims 06/27

- Jul 2 10:00 AM Factory Orders

I will be looking at the unemployment rate, initial Claims of Unemployment, and the Auto sales numbers carefully next week for more info on how much better the economy may be improving.

Labels:

consumer spending,

economy,

money finance

Wednesday, June 24, 2009

Save Money On Your Credit Cards

Two weeks ago I started a series which I am trying to continue. It's all about different ways to save money. This Thursday I would like to look at a few ways you can save money with your credit cards. Most people use them, and most of the time they are worse off for doing so. If you know what you are doing and follow simple guidelines, credit cards can be an asset rather then liability to your finances. Here are a few tips to save you money on your credit cards.

#1 Reward Cards Are Not Always Rewarding

It may be tempting to get a rewards card, thinking for every dollar you spend you will earn redeemable points towards all sorts of cool gifts, but unless you pay your balance off in full each month, a rewards card will usually have a higher interest rate. If you are one of those people who pay off your balance right away, than Rewards cards will save you money, but on the other hand if you carry a balance, a normal card will be the money saver.

#2 Simply Ask for a Better Rate

After being a customer for 4-6 months, give the credit card company a call, and simply ask for a better rate. As long as you have been paying your card on time and do not have any other credit problems that have popped up recently, they will likely try and make you happy, and reduce your rate by at least a quarter of a point.

#3 Pay Off Your Entire Balance Each Month

This is probably the single most important tip. If you can't afford something, and can't pay off your balance in a month, then don't buy it. Credit card interest rates are super high compared to normal loans. Paying off part of your balance every month is a sure way to get into long term debt.

#4 Shop for the Best Rate

You will find a huge array of interest rates each credit card you are approved for has. If you jump right into a card offer, you will likely be borrowing at 1-2% higher then your could be. That small percentage really ads up over time if you are not one of those people who pays off their card each month. Shop online for the best rates, and see which ones approve you.

#5 Never Ever Take a Cash Advance

Most Credit card companies will allow you to take a cash advance. This is a straight up cash loan. The problem is that the interest rate is usually quite a bit higher than the normal credit card rate. To make things worse, if you carry a balance, that balance will be paid off before the cash advance loan is since it is more profitable for the credit card company to use your payments towards the lower interest rate balance. If you need cash, go to the bank and get a loan. Even with bad credit your loan will have a much better rate from the bank.

Follow These 5 tips to the best of your ability, and you will not only save money, but have a much better control of your credit card debt.

#1 Reward Cards Are Not Always Rewarding

It may be tempting to get a rewards card, thinking for every dollar you spend you will earn redeemable points towards all sorts of cool gifts, but unless you pay your balance off in full each month, a rewards card will usually have a higher interest rate. If you are one of those people who pay off your balance right away, than Rewards cards will save you money, but on the other hand if you carry a balance, a normal card will be the money saver.

#2 Simply Ask for a Better Rate

After being a customer for 4-6 months, give the credit card company a call, and simply ask for a better rate. As long as you have been paying your card on time and do not have any other credit problems that have popped up recently, they will likely try and make you happy, and reduce your rate by at least a quarter of a point.

#3 Pay Off Your Entire Balance Each Month

This is probably the single most important tip. If you can't afford something, and can't pay off your balance in a month, then don't buy it. Credit card interest rates are super high compared to normal loans. Paying off part of your balance every month is a sure way to get into long term debt.

#4 Shop for the Best Rate

You will find a huge array of interest rates each credit card you are approved for has. If you jump right into a card offer, you will likely be borrowing at 1-2% higher then your could be. That small percentage really ads up over time if you are not one of those people who pays off their card each month. Shop online for the best rates, and see which ones approve you.

#5 Never Ever Take a Cash Advance

Most Credit card companies will allow you to take a cash advance. This is a straight up cash loan. The problem is that the interest rate is usually quite a bit higher than the normal credit card rate. To make things worse, if you carry a balance, that balance will be paid off before the cash advance loan is since it is more profitable for the credit card company to use your payments towards the lower interest rate balance. If you need cash, go to the bank and get a loan. Even with bad credit your loan will have a much better rate from the bank.

Follow These 5 tips to the best of your ability, and you will not only save money, but have a much better control of your credit card debt.

Labels:

credit cards,

credit loans,

finance,

save money

Federal Reserve Interest Rate Move?

Today is a big one for those who follow the moves of the Federal Reserve. Today at 2:15 PM EST they will decide on the status of current rates. I'm standing pretty confident though that there will be no changes to the current rates this time around. They are currently hovering in the 0% - 0.5% range and will likely remain there for a couple more months.

The Federal Reserve also has to consider their Treasury buying activities. The current plan to buy treasuries will run it's course come September. Will they extend this plan? Another thing to consider is long term inflation. Ben Bernanke seems to think that he can leave rates low for some time before having to worry about the pending inflation, which will come eventually. In My opinion the Fed is stuck between a rock and a hard place with their interest rate options. They know that the eventual rise of rates will be needed to counter inflation, but, also know that if they begin raising rates now, it will likely send the stock market down, possibly weakening consumer sentiment and slowing the possible economic turnaround as a whole.

“They have to be really careful,” said Christopher Low, the chief economist at FTN Financial in New York City. “They may not be forceful because they are worried about how the market will react,” he said. “The Fed needs to communicate they are aware of the shift in inflation expectations and they take inflation fighting seriously.”

I expect them to at least keep rates at the current level for another few months, possibly starting to raise them sometime in the 4th quarter of this year. Although the initial reaction from the markets of a rate increase may be a sell off of equities, longer term it will show the markets a recovery is in the works, giving them more confidence.

The Federal Reserve also has to consider their Treasury buying activities. The current plan to buy treasuries will run it's course come September. Will they extend this plan? Another thing to consider is long term inflation. Ben Bernanke seems to think that he can leave rates low for some time before having to worry about the pending inflation, which will come eventually. In My opinion the Fed is stuck between a rock and a hard place with their interest rate options. They know that the eventual rise of rates will be needed to counter inflation, but, also know that if they begin raising rates now, it will likely send the stock market down, possibly weakening consumer sentiment and slowing the possible economic turnaround as a whole.

“They have to be really careful,” said Christopher Low, the chief economist at FTN Financial in New York City. “They may not be forceful because they are worried about how the market will react,” he said. “The Fed needs to communicate they are aware of the shift in inflation expectations and they take inflation fighting seriously.”

I expect them to at least keep rates at the current level for another few months, possibly starting to raise them sometime in the 4th quarter of this year. Although the initial reaction from the markets of a rate increase may be a sell off of equities, longer term it will show the markets a recovery is in the works, giving them more confidence.

Labels:

bernank,

fed,

interest rates,

rates. federal reserve

Monday, June 22, 2009

Recession of 2007 - 2009 Compared with Others

I thought it would be interesting to compare the current recession we are in to the average recession in the the last 25 years. Recession's are normal cyclical events that happen on average every 7-8 years or so. Although the media often blows things out of proportion, without recessions, we would eventually have bubbles in every market, which would eventually collapse, causing a much more severe event, called a depression.

In the last 15 years, not counting the last 2 which are part of the current recession, the average recession lasted only about 8 months. The current recession we are in right now, however has lasted over twice as long, at 17 months and running. With any recession, there is a bear market as well. The average bear market between 1983 and 2007 lasted 1 year (12 months). The current bear market that we just saw lasted 19 months. The bear market is over, at least for now, but the recession has yet to officially be declared over, and likely won't be for some time to come. Even if the recession is over, it will take about 4-5 months to determine that for a fact.

Despite the negativity of it all, there is some good news. The bear market appears over, thus we are likely at the start of a bull market run. A bull market, unlike it's evil twin brother, the Bear market lasts on average about 4 years or about 49 months. Since we are starting at such a low base, it is likely this bull market will be stronger than most. The average Bull market can show returns over 100%, with one third of that gained within the first 12 months. The lesson of this is that despite all the negative media over the last 12 months or so, things probably won't be as bad as most experts were predicting, and the great thing about it is that if you have cash on the sidelines, and a little risk to bare, now is an amazing time to invest in the market with a long term horizon.

In the last 15 years, not counting the last 2 which are part of the current recession, the average recession lasted only about 8 months. The current recession we are in right now, however has lasted over twice as long, at 17 months and running. With any recession, there is a bear market as well. The average bear market between 1983 and 2007 lasted 1 year (12 months). The current bear market that we just saw lasted 19 months. The bear market is over, at least for now, but the recession has yet to officially be declared over, and likely won't be for some time to come. Even if the recession is over, it will take about 4-5 months to determine that for a fact.

Despite the negativity of it all, there is some good news. The bear market appears over, thus we are likely at the start of a bull market run. A bull market, unlike it's evil twin brother, the Bear market lasts on average about 4 years or about 49 months. Since we are starting at such a low base, it is likely this bull market will be stronger than most. The average Bull market can show returns over 100%, with one third of that gained within the first 12 months. The lesson of this is that despite all the negative media over the last 12 months or so, things probably won't be as bad as most experts were predicting, and the great thing about it is that if you have cash on the sidelines, and a little risk to bare, now is an amazing time to invest in the market with a long term horizon.

Sunday, June 21, 2009

Could A National Strike in Iran Spike Oil Prices?

The situation in Iran, which I wrote about briefly last week appears to be getting worse as each day goes by. The Defeated candidate, Mousavi, is rumored now to be ready to announce a National strike in Iran which would start with the Oil industry. The question has to be asked... How much will a national strike on the part of Iran affect the international price of oil?

Oil Prices Already Rising

With Summer beginning Yesterday here in the US, Gas prices are already averaging around $2.70 a gallon. Oil Prices have doubled since their lows only a few months ago. If Mousavi does in fact called for a national strike, how high could that make prices go? Technically, the other nations should make up for any production stoppages in Iran, but just the mental impact of the Iran mess could very well send prices back to $90 - $100 by August in my opinion. As you can see Below in the world map of the largest Oil Producing Nations, although tiny geographically, Iran has the third largest oil reserves and currently is responsible for about 8% of all Oil production in the world, with 3.7 million barrels of production per day.

With the economy seemingly getting better, we could be in for another oil price jump. I do not see it getting to $150 a barrel like last year though. Investors will be too hesitant to carry prices over the $100 mark in my opinion for fear of another collapse like we had int he last 12 months.

Oil Prices Already Rising

With Summer beginning Yesterday here in the US, Gas prices are already averaging around $2.70 a gallon. Oil Prices have doubled since their lows only a few months ago. If Mousavi does in fact called for a national strike, how high could that make prices go? Technically, the other nations should make up for any production stoppages in Iran, but just the mental impact of the Iran mess could very well send prices back to $90 - $100 by August in my opinion. As you can see Below in the world map of the largest Oil Producing Nations, although tiny geographically, Iran has the third largest oil reserves and currently is responsible for about 8% of all Oil production in the world, with 3.7 million barrels of production per day.

With the economy seemingly getting better, we could be in for another oil price jump. I do not see it getting to $150 a barrel like last year though. Investors will be too hesitant to carry prices over the $100 mark in my opinion for fear of another collapse like we had int he last 12 months.

Friday, June 19, 2009

Cash for Clunkers Program and Next Week

It's Friday again so another look at the week ahead, but first I want to talk a little about the Cash For Clunkers Program that was just approved by the government.

Cash for Clunkers Program

The Program today was approved by the Senate and just needs Obama to sign it into law. It gives consumers with cars that get less than 18 miles per gallon the ability to turn them in for a $3,500 or $4,500 cash credit. This could be huge for the economy, and will also make a lot of environmentalists happy. It might be enough for me to consider buying into some auto stocks. Although, "Cash for Clunkers," will not save the auto industry by itself, it could pave the way for quite a nice rebound. Those companies which make the more fuel efficient vehicles should see the most benefit. Only if the 300 Mile per gallon car, the Aptera was selling yet.

Next Weeks Economic Data

- Jun 23 10:00 AM Existing Home Sales May

- Jun 24 8:30 AM Durable Orders May

- Jun 24 8:30 AM Durable Orders, Ex-Transportation May

- Jun 24 10:00 AM New Home Sales May

- Jun 24 10:30 AM Crude Inventories 06/19

- Jun 24 2:15 PM FOMC Rate Decision

- Jun 25 8:30 AM Initial Claims 06/20

- Jun 25 8:30 AM Q1 GDP - Final Q1

- Jun 26 8:30 AM Personal Income May

- Jun 26 8:30 AM Personal Spending

- Jun 26 8:30 AM PCE Core May

- Jun 26 9:55 AM Mich Sentiment-Rev

A Few of Next Weeks Earnings releases:

Walgreens - Monday

Oracle - Tuesday

Nike - Wednesday

RedHat - Wednesday

Rite Aid - Wednesday

Wyeth - Wednesday

Cash for Clunkers Program

The Program today was approved by the Senate and just needs Obama to sign it into law. It gives consumers with cars that get less than 18 miles per gallon the ability to turn them in for a $3,500 or $4,500 cash credit. This could be huge for the economy, and will also make a lot of environmentalists happy. It might be enough for me to consider buying into some auto stocks. Although, "Cash for Clunkers," will not save the auto industry by itself, it could pave the way for quite a nice rebound. Those companies which make the more fuel efficient vehicles should see the most benefit. Only if the 300 Mile per gallon car, the Aptera was selling yet.

Next Weeks Economic Data

- Jun 23 10:00 AM Existing Home Sales May

- Jun 24 8:30 AM Durable Orders May

- Jun 24 8:30 AM Durable Orders, Ex-Transportation May

- Jun 24 10:00 AM New Home Sales May

- Jun 24 10:30 AM Crude Inventories 06/19

- Jun 24 2:15 PM FOMC Rate Decision

- Jun 25 8:30 AM Initial Claims 06/20

- Jun 25 8:30 AM Q1 GDP - Final Q1

- Jun 26 8:30 AM Personal Income May

- Jun 26 8:30 AM Personal Spending

- Jun 26 8:30 AM PCE Core May

- Jun 26 9:55 AM Mich Sentiment-Rev

A Few of Next Weeks Earnings releases:

Walgreens - Monday

Oracle - Tuesday

Nike - Wednesday

RedHat - Wednesday

Rite Aid - Wednesday

Wyeth - Wednesday

Thursday, June 18, 2009

10 Homes Between $99 - $10,000

I heard a lot about homes, especially in Detroit selling for under $10,000, and a few under $1000. I thought it was a joke, so I did a bit of research, and was amazed at what I found. Here are just a few of the cheap homes I found.

$99 - Detroit Michigan

Alright I know it looks crappy, and needs a lot of work, but for a price that you'd pay for a nice dinner for 2 you can have a 1100 square foot home with 3 bedrooms, and the land that it sits on at 13960 Marlowe St.

$250 - Detroit Michigan

Another steal? It doesn't look great on the outside, and probably not on the inside either, but for $250 this home, built in 1920 and located on 9750 Bryden St seems like a good buy. Has 3 Bedrooms and 1 bath, and is 858 square feet. >>>More details

$500 - Detroit Michigan

How can you go wrong with this 4 bedroom, 1700 Square foot home on 15486 Ardmore St in Detroit? With a 30 year fixed rate mortgage you'd pay about $3 a month for this beauty. Ok, maybe it;s not a beauty but $500????

$500 - Detroit Michigan

Wow, what a steal. This home which is located in downtown Detroit can be had for less than you'd pay for a new laptop. With 2 Bedrooms and 1 bath, and 850 square feet, how can you go wrong. The outside looks nice at least.

$4,400 - Pontiac Michigan

This one actually looks like it's not all that old or dilapidated. It's only 500 square feet, and has 2 BR's and 1 Bathroom, but for a price lower than that of a Really nice Plasma TV, how can you go wrong?

$4,900 - Flint Michigan

Located on 5317 Dupont Street, this home built in 1950 is 781 Square feet with 2 Bedrooms and one bath. Not a bad buy if you are a handyman. The outside seems old, but workable.

$6,500 - Flint Michigan

This home on 2621 Wisner Street, in the hurting town of Flint, is goign for a steal. Has 821 square feet of living area and 2 bedrooms. Built in 1956. More details can be found at: Cheap Home

$9,900 - Detroit Michigan

Is it me or does this actually look like a home that would sell in the $100k range in any other area. At 1500 square feet, this monster of a home seems like a sure steal. >>>More Info

$9,900 - Minneapolis Minn.

This 2 story home is an old one, but with with 3 Bedrooms, and 1100 square feet of living area in the heart of Minneapolis, this 109 year old (Built in 1900) home could be a gem if fixed up.

$10,000 - Lansing Michigan

This Home, built in 1906, on 1101 N Larch Street, could be a gem at $10k. It features 3 bedrooms, 2 baths, a full basement, and a 1.5 car garage. It is entirely brick, and judging from the pictures isn't in all that bad condition on the outside, at least.

Tuesday, June 16, 2009

Stocks to Protect Against Inflation

Inflation is all but certain in this economy. The government has interest rates set as close to 0 as you can get, plus they are buying up treasuries. Sooner or later, the printing press's will have to be put to work, and with that, comes inflation. I, by no means, expect to see hyper inflation, or even inflation rivaling that which we saw in the 70's and 80's, however, we will have it, and it will be strong in my opinion.

So, what does one look for when investing in stocks that will protect you against inflation? Well, first and foremost, the stock market is not a terrible place to have your money when inflation is upon us. Inflation is a rise in prices. When prices rise, that means it is likely that your stocks will be earning more money. What you want to look for are stocks which are quickly able to adjust prices, as well as companies which are not effected by the rising costs of raw materials. You want companies which have fixed costs such as machinery, real estate, or labor, rather then those that rely on a lot of buying of materials. You also want to look at companies which sell food, beer, wine, cigarettes, and oil. Here are just a few:

ConocoPhillips (COP)

They have a business that is tied more towards the actual oil price then most of their competition.

Molson Coors (TAP)

They rely on less raw materials then their competition. That;s why maybe their beer is usually more watery. Might not be good for the taste buds, but during times of inflation, their costs rise less than their revenue.

Eli Lilly (LLY)

They make important and vital drugs. Their dividend yield is 5.8%, and people don't stop buying drugs they need to survive when inflation hits.

Remember to diversify your holdings and don't just invest in stocks. Keep some cash on the sidelines so you can react to any changing conditions, and also consider a small amount of gold or silver as a precaution to unforeseen economic events.

Monday, June 15, 2009

How Twitter, Iran, and #iranelection Is Changing Media for Good

I don't usually blog about much other then the Economy, Finance, and Business related topics here, however given that this is quite a big story, and is somewhat related to business I had to do a quick post about the changing lines in the Media world.

Twitter and #iranelection

In ten years from now we may look back at this Iranian election mess and say, "that's when media distribution changed forever." That's because Twitter has shown us how much more informative and valuable it is compared to the traditional news outlets such as CNN. Anyone who goes to Twitter and searched for #iranelection will see a feed of hundreds of new tweets every couple minutes, many from people inside Tehran Iran with their smartphones posting continual updates of what they are seeing. It is really quite amazing how fast news can spread. Pictures taking by Iranian tweeters are hitting twitter hours before any traditional news outlet releases them. News of violence, deaths, and unrest in Iran are being published seconds after they occur for the world to see.

How Twitter and #iranelection is Helping Iranians

Not only is Twitter changing the media sphere for good, but it is also having a tremendous impact on Iranian citizens who are impacted by the mess of this election. Iran has been blocking local IPs from accessing News sites, Facebook, and even Twitter. American's and people in other countries have been setting up proxy servers and trying to get the information to the Iranians who which to access the information that their Government has been blocking. Twitter is in effect helping to spread freedom of speech and democracy throughout the world.

Sunday, June 14, 2009

3 Possible Scenarios for The Bull Stock Market

Over the last 3 months we have seen the major US markets rise almost 40%. That is an unprecedented increase in stock prices, one that any investor would love to have in a 5 year period, much less only 3 months. Investors however are now asking, "what's next?" Below are 3 arguments and my personal opinion on their likelihoods of happening:

The Market Is Overbought and Sells off for Big Losses, Dow Back to 7000

It is possible that the market has gotten too far ahead of the economy. The markets are usually 6 months ahead of the economy, so right now it's pretty much saying that a recovery will be in the works within 6 months. A 40% gain in only 3 months is staggering, and even if things were looking amazing for the economy such a gain is hard to maintain without some pullback. Could we pull back into the 7000-7500 range for the dow?

I give this a 20% chance of happening.

We level Off but maintain current levels for the next few months?

Even though the market has risen quite a bit, the optimism and good values keep things steady and in a range of 8500-9000 for the next few months until we get more solid news on the status of the recession. A mix of good and bad news will keep things bouncing around in a rather narrow range until August or September.

I give this a 45% chance of happening.

Good news continues to keep the Market Rising, perhaps to 10,000 - 10,500 by September.

With stocks that were way undersold, still being cheap, and news continuing to mount that the recession is all but over, the markets could react favorably. Sure we have gone up 40% in 3 months, but in order to get to level we were at before the whole Lehman Brothers mess, we would still have to rise another 25-30% from were we are at right now. With a mixture of Good news, and companies reporting earnings better then expected for the 3rd quarter, we could see the dow approach the 10,000 mark or even higher by September.

I give this a 35% chance of happening.

Friday, June 12, 2009

Iran: Hossein Moussavi Win May Help the Markets

Once again we have hit the end of the week, and that can mean only one thing. Our traditional end of week look ahead. This week has been pretty flat in terms of the stock market. We did get some more encouraging news when we found that new unemployment forms were not as high as expected. In addition to the whole array of economic news we expect next week, we should also get results from Iran on their National election. Right now it looks as though, Mir Hossein Moussavi, who is friendlier to the West, may beat out the President, Mahmoud Ahmadinejad. Although the Nuclear ambitions of Iran may not change with either candidate, a victory for Moussavi could affect the markets a bit positively. Below is the list of data that we will be receiving next week:

Once again we have hit the end of the week, and that can mean only one thing. Our traditional end of week look ahead. This week has been pretty flat in terms of the stock market. We did get some more encouraging news when we found that new unemployment forms were not as high as expected. In addition to the whole array of economic news we expect next week, we should also get results from Iran on their National election. Right now it looks as though, Mir Hossein Moussavi, who is friendlier to the West, may beat out the President, Mahmoud Ahmadinejad. Although the Nuclear ambitions of Iran may not change with either candidate, a victory for Moussavi could affect the markets a bit positively. Below is the list of data that we will be receiving next week:- Jun 15 8:30 AM NY Empire Manufacturing Index Jun

- Jun 15 9:00 AM Net Long-Term TIC Flows Apr

- Jun 16 8:30 AM Building Permits May

- Jun 16 8:30 AM Core PPI May

- Jun 16 8:30 AM Housing Starts May

- Jun 16 8:30 AM PPI May

- Jun 16 8:30 AM Building Permits May

- Jun 16 8:30 AM PPI May

- Jun 16 8:30 AM Core PPI May

- Jun 16 9:15 AM Capacity Utilization May

- Jun 16 9:15 AM Industrial Production May

- Jun 17 8:30 AM Core CPI May

- Jun 17 8:30 AM CPI May

- Jun 17 10:30 AM Crude Inventories

- Jun 17 10:35 AM Crude Inventories

- Jun 18 8:30 AM Initial Claims 06/13

- Jun 18 10:00 AM Leading Indicators May

- Jun 18 10:00 AM Philadelphia Fed Jun

I will be paying close attention to the Building Permits number on Tuesday, as well as the initial claims of unemployment on Friday, as both could show that the economy is well on the way to recovery. If the Initial claims number continues to slide downward, we may be in pretty good shape. As for Next weeks earnings reports, there are not too many. I would venture to guess that next week is one of the deadest week for earnings all year, or at least in the quarter.

Thursday, June 11, 2009

Price of Oil - Where are Oil Prices Headed?

One of the driving forces behind any economy are it's energy prices. Pretty much every business around the globe is affected directly or indirectly by the price of oil. This is why the huge fluctuations in Oil prices we have seen over the last 2-3 years are quite turbulent for the economy in general. In the last 3 months alone we have seen the price per barrel of oil rise by about 80%. That's almost a 1% gain per day over the last 3 months. This is after we saw Oil prices fall from $150 a barrel all the way down to $35. Take a look at the chart below to see how much prices have increased since the bottom of the recession.

Will Oil Prices Hurt Our Recovery?

This is a tough question to answer. As long as prices don't come close to the highs of last year I don't personally see it being a major dagger in the heart of the recovery. We are in the Summer months, and some price increases were all but guaranteed. We are still at about half of the highs that we saw last year, so we should be thankful of that.

Where are Oil Prices Headed?

You could ask a hundred experts this question and get a hundred different answers. In my opinion, It would surprise me if we saw prices go above $100 a barrel within the next year. The world economies are still fragile, and demand is not as high as they were before the recession, nor will it be for quite some time. As long as OPEC does not cut production any further I think prices should level off in the $60-$80 range for the next 12-18 months at least.

Labels:

gasoline,

oil,

oil prices,

prices,

recession

Wednesday, June 10, 2009

Save Money on Heating and Cooling Your Home

With all the talk recently of cleaner greener energy use, I thought I'd start a series here with different ways to save energy, since saving energy also means saving quite a bit of money, something we all can use in this economy. So, here is a short list of things you can do to save money and energy with the heating and air conditioner systems of your home:

- Clean or Replace Filters on your furnace at least every 2 months

Dust buildup can lead to less air making it's way into your home, meaning your furnace will need to run harder, longer. It can also be a carbon monoxide hazard.

- Install New Smart Thermostats

New thermostats allow the owner to program them so that at certain times of the day, according to ones schedule, the temperature can be switched higher or lower. It is pointless to heat or cool a home when you are not there.

- Insulate heating ducts in unheated areas such like the attic and crawlspaces and keep them in good repair to prevent heat loss.

Up to 60% of the heat produced by your furnace can be lost by poorly insulated ducts. Considering that half of a families electric bill can be used on heating their home in the winter, that means the average bill could be reduced about $30 a month with proper duct insulation.

- Install and Use Fans during the summer months.

A fan causes a windchill effect. Having a fan on will allow you to increase your thermostat in the summer 4 degrees F, and still feel just as comfortable. Also, in the Winter, a fan can be used to circulate the warm air that has risen to the ceiling down toward where you are.

I will try and continue this series with other energy tips throughout the next few weeks. I thought that since we are in the Summer months here in the US, I would provide the Heating and Cooling section first.

Monday, June 8, 2009

5 Money and Investing Misconceptions

Since there isn't all that much to discuss about the markets yet this week, I thought I'd write a little post about some of the misconceptions I have heard throughout the years about finances, money, and investing in general. Here they are The 5 Money Misconception:

#1 Investing in Stocks Is the Same as Gambling

This is the furthest from the truth as you can get. Over the last 50 years the Dow has had an average return of close to 11% per year. That is a heck of a lot more money then your average return at a casino which is guaranteed to be a loss if you play long enough. Investing in stocks you know nothing about for the short term is the same as gambling, but investing in stocks which you have researched, and diversified, and leaving the money in them for a few years will almost always have a positive return. Diversification and patients are key. Even those people who invested in a diverse portfolio right before the market crash of 1929 would have has gains if they held long enough.

#2 The Misconception between "Good Debt" an "Being in Debt".

There is a major difference between being in debt, and having debt. Being in Debt is never positive. You are in debt if your assets you own are valued less then the assets you owe. This situation is never good, and it means you are spending more money then you are making, and will likely lead to all sorts of problems. On the other hand, having debt means owing money. For instance you may take out a mortgage for a house. You may owe $200,000, but likely the home value is greater than that $200,000. Even if you have cash to buy a home, sometimes it's better to take the mortgage (debt) and invest the cash in an investment vehicle that yields more than the rate you are paying on the mortgage. In that case, the debt is "Good Debt".

#3 The Wealthiest Americans are those Who Work Hard at their 9 to 5 Jobs

The facts are that it is nearly impossible to become very wealthy working for someone else. Over 90% of Americans with a net worth of over $8 million got their wealth by either starting up their own business or an inheritance.

#4 Money is Only for Buying Stuff

Most people think that the sole purpose of money is to buy things to make us happy. The people who are the happiest though are those that save money. Wondering why? Some of the biggest problems we face revolve around money. Not what we can and can not buy, but our long term piece of mind. Those people who save money and invest it, are much happier, healthier, and much more worry free then those who send their money more liberally. Buying something may make us happy for a few hours or days, but knowing that we have no financial obligations, and have financial freedom can make us happy for a lifetime. 50% of all Marriage conflicts revolve around money problems.

#5 If all the Experts are Investing in Something, it must be a Great Investment

The facts are that those who stray from the herd are usually the ones to succeed. This means buying when everyone else seems to be selling (case in point, when I recommended buying into the market in the 7000 range a few months back when the media was filled with gloom and doom.), and selling when everyone else seems to be buying. Take for instance the housing bubble. All the experts were telling us how great a value real estate still was, even though in some areas prices had doubled in only 5-6 years time. Mass buying or selling usually results in a market correction that will likely cause a bubble to collapse. Be your own person. Think for yourself.

Labels:

finance,

financial,

investing,

mistakes,

money misconceptions

Sunday, June 7, 2009

Mortgage Interest Rate History

Well It's Monday so I thought we'd do another chart here, as I love looking at charts filled with lots of good information. The chart/graph below shows the various types of mortgage rates for the last 17 years:

Mortgage Rate History

I'm concentrating on the Red and orange lines, which are the 30 year and 15 year fixed rate mortgage rates. If you just take a quick glance at them, you can clearly see that we are at the lowest rates, by far, in the last 17 years. In my opinion, if you can refinance your mortgage, this IS the time to do it. Don't wait. I personally feel this will be just about the lowest rates many will see in perhaps their lifetime. We are about 40% lower the the highs we saw in the early 1990's, and probably won't be going down any further from here.

Buy Outright, or Take a Mortgage?

Many people who have the cash to buy a home will buy the home outright. Sure, this will give you the piece of mind, knowing you owe nothing, and will likely never have a worry in the world about your home's affordability, however, it may not be the smartest move right now. If you can get a mortgage for 5%, it may be best to take it regardless if you can buy the home outright or not. Why? Inflation will likely go up quite a bit in the coming years. The FED will likely raise interest rates by quite a but over the next few years, meaning bank Certificates of deposits could possibly be paying an interest rate, in 2-3 years, higher then what you can take a mortgage out for today. f you can borrow $500,000 at 5% and get a CD or bond for 6%, you are making a cool $5000 a year profit. Just something to think about.

Conclusion

In my opinion, we have clearly struck a floor with interest rates, and anyone who hesitates on refinancing now, will likely regret it pretty soon.

Labels:

bonds,

history,

homes,

interest rates,

make money,

mortage rates,

mortgage

Friday, June 5, 2009

Week of June 9th - Economic Events

Well it's Friday again, and that means it's time for an overview and look ahead at next week. This week has been phenominal if you are long the market in any sector pretty much. Much of the data we received this week has indicated that the recession is clearly on it's way out, and the predictions of 3rd Quarter growth seem like they will be dead on. Today we found out the total number of new jobless claims has fallen considerable. Although the unemployment rate has risen to 9.4%, it seems as though we may not get to the 10% mark that I thought we may. Companies like Walmart are starting to hire again as they expand, and most companies who are going to lay off workers already have. I could honestly see the unemployment rate turning lower sometime in September if things keep up. Below is a list of the data we will get next week:

- Jun 9 10:00 AM Wholesale Inventories Apr

- Jun 10 8:30 AM Trade Balance Apr

- Jun 10 10:30 AM Crude Inventories

- Jun 10 10:35 AM Crude Inventories

- Jun 10 2:00 PM Treasury Budget May

- Jun 10 2:00 PM Fed's Beige Book

- Jun 11 8:30 AM Retail Sales May

- Jun 11 8:30 AM Retail Sales ex-auto May

- Jun 11 8:30 AM Initial Claims

- Jun 11 10:00 AM Business Inventories Apr

- Jun 12 8:30 AM Export Prices ex-ag. May

- Jun 12 8:30 AM Import Prices ex-oil May

- Jun 12 9:55 AM Mich Sentiment-Prel Jun

I am going to pay close attention to the crude inventories, especially since the price of oil is on a major rebound. Also the Fed's beige book and Business inventories should clarify the economic conditions even more. As for Companies reporting earnings, there are not too many big names reporting next week. That will change in the coming month. Could we see the Dow break the 9000 mark sometime this month? I certainly think so!

Wednesday, June 3, 2009

74 Forums About Making Money Online

I have been running internet business's since I was 15 years old. I started off selling baseball cards on a bulletin board (forum) on Prodigy, and now have dozens of websites in a range of categories, selling all sorts of stuff. If it wasn't for internet forums, I would never have had the inspiration of knowledge to do the things I currently do.

Webmaster Related (Forums dedicated to earning money running and managing websites. SEO tips, webmaster dialogue, and more)

- 1. DigitalPoint.com - Webmaster community where one can learn to make money running a website. Many great Tips and tricks

- 2. SitePoint.com - A webmaster haven. Many great internet gurus are here.

- 3. WebMasterWorld.com - Another Webmaster forum which talks a lot about Adsense. Big name players are here including Google employees themselves.

- 4. SearchEngineWatch.com - Really good section about Google. Discusses all types of SEO related topics

- 5. Ozzu.com - Pretty Much discusses everything related to running and hosting a Website

- 6. V7n.com - Focused on Site design, with a nice marketplace and SEO folder.

- 7. HtmlForums.com - Everything you need to know about Html, programming, graphics, e-commerce and more.

- 8. Devshed.com - Probably the most comprehensive Programming and development forum online. Folders for all programming languages.

- 9. SeoChat.com - Focused almost completely on SEO. Some really smart people with a lot of great insight post here.

- 10. WebTalkForums.com - Focused almost completely on website promotion and development.

- 11. WebDeveloper.com - Generally about programming and scripting websites with sections on domain names, and other money related topics.

- 12. TheAdminZone.com - Focused on forum administrators, and how to make money with an internet forum.

- 13. CreateBlog.com - Focused completely on website coding and designing

- 14. Cre8aSiteForums.com - Everything from Website development to monetization discussed here.

- 15. Daniweb.com - Website creation and marketing discussed here.

- 16. TalkFreelance.com - Very Large webmaster marketplace, and huge Freelancer community.

- 17. BloggerForum.com - Focused on the Blogging community and how to monetize a blog.

- 18. WebHostingTalk.com - Geared towards hosting resellers but has some relevant sections on making money selling hosting and running a website. Very active.

- 19. HostingForum.ca - Canadian version of Webhostingtalk. Focus's mainly on website scripting.

- 20. HostingDiscussion.com - Focused almost completely on website hosting and selling hosting for a profit.

- 21. Forum4Designers.com - Really good forum for coding, html, and graphics.

- 22. Webmaster-Talk.com - Pretty much dedicated to anything webmaster related, but focused on the coding and design aspects.

- 23. IwebTool.com - General Webmaster talk and marketplace'

- 24. WebExpertz.net - Geared mostly towards Java script programming, with a nice section about making money online.

- 25. HighRanking.com - Spans all webmaster topics, with a really good Internet marketing section

- 26. WebMasterForumsOnline.com - Not as active as some of the others, but has a nice marketplace section for buying and selling web services and sites.

- 27. WebMastersHelp.com - Pretty much a quieter form of Sitepoint. Moderators seem active but not as many active members.

- 28. SeoGuy.com - Rather quiet, but there are some SEO experts posting here.

- 29. FrontPageWebmaster.com - A Webmaster learning community. Many different programming language topics, as well as a site critique seciton.

- 30. UkWebMasterWorld.com - Moderately crowded. Based in the Uk, and has a great business section.

- 31. SearchEngineForums.com - Some really good folders about Google optimization and Google Adsense.

- 32. WebDesignForums.net - Everything related to creating a website.

- 33. WebForumz.com - Large selection of webmaster related topics.

- 34. IHelpYou.com - Almost completely about SEO. They have a really good Help and Advice section.

- 35. SeRoundtable.com - Just made the cutoff in terms of traffic, but the good Google related section gave it a bump.

- 36. SeoBlackHat.com - Private forum for discussing the often criticized black hat techniques of getting search engine traffic.

- 37. NetPond.com - The largest forum for adult webmasters.

- 38. AdultWebMasterinfo.com - The second largest adult webmaster related site.

Miscellaneous (These are general categories, but all list below are forums which will give you a ton of information on various online revenue streams, and opportunities):

- 39. Talkgold.com - This is our own forum. Pretty much covers every Money making opportunity there is online from Hyips, to Forex, to Running a website to blogging.

- 40. GeekVillage.com - Really good section for making money online, as well as other related topics.

- 41. RevenueSource.com - Discusses different ways to make money online. A variety of topics.

- 42. WebLife.org - Not as busy as it once was., but a lot of good topics and moderators.

- 43. DnLodge.com - Focused on a variety of topics including domain names and site design.

- 44. FreeWebSpace.net - Nice section on internet advertising, as well as design and Free web hosting.

- 45. MarketingChat.org - Barely made the list because of low traffic, but there is a lot of great information about several money making topics here.

- 46. TheFreeAdForum - Place for webmasters to advertise their sites and opportunities to make money.

- 47. FreeAdvertisingForum.com - Great place for webmasters to post ads to their site for free.

- 48. SiteOwnersForums.com - A variety of topics including a "Making Money on the Web" section

- 49. AkaMarketing.com - Covers a large assortment of webmaster money making topics.

- 50. RolClub.com - Focused on Iraqi Dinar investing via the internet, with sections for hyips and autosurfs as well.

- 51. EWealth.com - Focused on a variety of topics. Anything related to making money online is discussed here.

- 52. MoneyTalkPro.com - Focused on risky online programs like HYIPs and Autosurfs, but discusses a variety of other money related topics.

- 53. MoneyMakerGroup.com - Another forum dedicated more towards High yields investing and risky programs. Also has various other money making topics.

- 54. DreamTeamMoney.com - Focus's on Hyips and Get to to surf programs, and has a unique points system.

- 55. HotSurfs.com - Focus's on Hyips, but also discusses a variety of other money making topics.

- 56. Code4Gold.com - Focus's on E-currencies, Hyips, and webmaster related issues. Admins are not too fond of Talkgold, but this list isn't biased ;) It deserves to be here.

Domain Name Related: (Whether you are buying and selling domain names, or simply investing in them, developing them, and putting ads on them, there are a whole array of ways to make money in the domain name industry)

- 57. DnForum.com - The Grand Daddy of all Domain name related forums. They do have various paid membership upgrades. Learn to Invest in Domain names.

- 58. NamePros.com - The second most popular Domain name oriented forum. Greta place for appraisals. No paid memberships like DNForum.

- 59. DomainState.com - Not as busy, but they have a great News section to see what past domains sold for.

- 60. DiscussNames.com - Focused on Domain name Appraisals and buying and selling of of Domains for profit.

- 61. DomainForums.com - A quieter version of DNForum.com.

- 62. AcornDomains.co.uk - A UK based domain name appraisal, and marketplace discussion.

- 63. DDBoard.com - Various webmaster topics discussed here with a bulk being domain name oriented.

- 64. IdnForums.com - Domain name discussion with folders based in 11 different languages.

- 65. DnsScoop/com - Large Domain name marketplace section as well as other webmaster related topics.

Affiliate/Internet Marketing Related: (Want to sell others peoples products and get as much as 75% commission. These forums teach you the ins and outs of the industry)

- 66. ABestWeb - Dedicated to everything related to Affiliate marketing. Largest Affiliate forum online

- 67. WarriorForum.com - One of My Favorite forums related to Internet Marketing in General.

- 68. AssociatePrograms.com - Really good forum for affiliate marketing and earning online.

- 69. WickedFire.com - All about internet marketing and generating traffic to your website.

- 70. Affiliates4u.com - Discusses ways to earn through affiliates and other means of website ad publishing.

- 71. 5StarAffiliatePrograms.com - Very Organized affiliate related discussions.

- 72. AffiliatePrograms.com - General Affiliate marketing discussion.

- 73. ClickBankSuccessForum.com - Really great community for people who sell ebooks via clickbank.

- 74. Im4Newbies - A WarriorForum for people just getting started in internet marketing. Good information found here.

This list is just the tip of the iceberg, however they are the main ones that most of the online entrepreneurs use.

Labels:

74,

forums,

make money,

make money online

Whats the Better Investment Now - Stocks or Bonds?

With the stock market up nearly 30% from it's lows only 3 months ago, many investors are speculating that it may now be time to consider investing in Bonds, which could pay off better then stocks int he long run. That's at least what some experts are saying. Me, on the other hand, disagree.

Bonds:

Bonds are still yielding extremely low rates of return compared to the past. The 10 year Treasury is paying just about 3.6%. That's not terrible, but you have to consider that inflation could easily reach 3.6% within the next year, and likely will go a bit higher than that. If inflation strikes like many experts think, we could see 10 year Treasuries paying over 6% easily, meaning those lowly 3.6% bonds you purchase today will be worth about 60% then. I, in fact, do like some of the more risky corporate bonds, where you can get a return as high as 10% on companies which really are not in that bad shape.

Stocks

Right Now, even though the market is up 30% from it's lows, I am still a stock guy. Although I do own some bonds, I believe that the stockmarket is the place to be. Why in the world would you buy a 3.6% Treasury bond that is locked in for 10 years, when you can buy a stock like Verizon (VZ) which has a 6.25% dividend, you can sell whenever you like, and will likely increase it's share price over the long run with or without inflation. If you are looking for the stable return of bonds, then buy some of the blue chip dividend stocks like Intel, BP, Pfizer, Bristol Myers Squibb, Altria, etc. You will get a pretty reliable stable return higher than 3.6% plus have the stock price gain to look forward to as well.

Conclusion:

Stocks are still an excellent buy. With the economy picking up finally, most dividend stocks which have yet to cut their dividends will likely be safe from here on out.

Tuesday, June 2, 2009

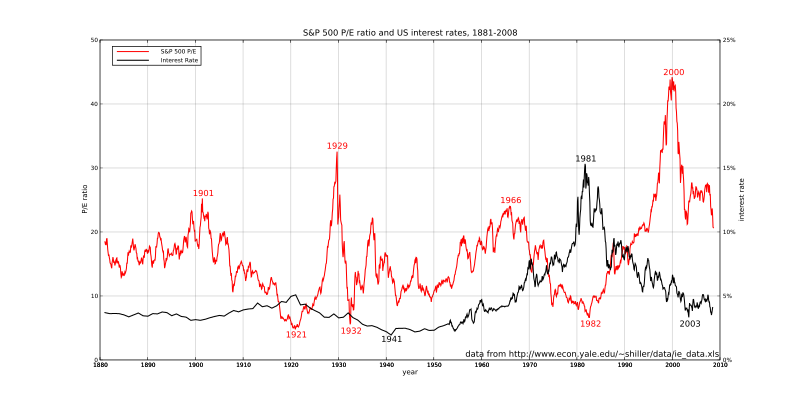

Historic PE Ratios Compared to Interest Rates

I don't have all that much news to bring to you all today so I thought I'd take a look at another chart. Below is graph of Interest rates vs the PE Ratios (Price to earning ratios of the S & P 500) over the last 120 years in the United States:

Like I said before I love looking at graphs and charts because they can tell you more than an entire 10 page essay could in just a few seconds. As you can see, we are currently at a pretty high average PE ratio, but having said this, it is so much lower then it was just a few years ago. You also must account for the fact that there is now optimism in growth, so a higher than average PE ratio is not all that bad. The current graph, however, leads me to believe that we may see a leveling off of the Dow at around 9000-9200, where it may stay and hover around for some time until better earning reports come out.

For those of you not familiar with PE ratios, it basically is the return a stock has over a year. If you have a PE ratio of 20, that means it will take the company 20 years to make a profit equal to it's current share price. Divide 100 by the PE ratio and you will get the rate of return the company is making. For instance 100/20 = 5, which means investing in the stock will provide a 5% annual return. Looking at the chart above you can see that in 1982, PE ratios were low, while interest rates were high. Is is because people could make a ton of interest just buying bonds, so why invest into stocks that have a yield lower then bonds do, at greater risk.

It should be interesting to see, how inflation could hamper the recovery of the US stock market should it go up by more then a few basis points.

Monday, June 1, 2009

General Motors Bankrupt, Household Income Up

What a start to the day! Not only is it the first day of the second half of the year, but we are also getting all kinds of news and seeing movement in various investments.

GM Bankruptcy

General Motors today filed for bankruptcy protection. The United states government, yes us tax payers, will own about 60% of the US auto maker. Although a bankruptcy is far from good news, the markets were expecting it, and now that it has happened, it's out of the way, and any uncertainty is finally lifted.

Gold Approaches $1000 Mark

For the third time in the last 18 months or so, Gold has approached the $1000 mark. Helped by rising energy costs and a lower dollar, prices could soar past that mark. Many experts predict that if Gold can hold above $1000 for a third time, and make even the slightest move above it, we could be headed for a Gold rally not seen in years.

Technology Booming

The E3 Video Game conference is today, which means we will likely see some new technological advances in the Video Game market. This along with the Fact that Microsoft's new search engine, Bing, has launched this morning, and Google announced a possible game changer of a communications setup, called Google Wave, last week, the tech sector is on a role. Expect this to continue into next weeks Apple conference.

Personal Income Rose

For the month of April, Personal income rose an unexpected 0.5%. This was well above the drop of 0.2% most economists were predicting. Yet another signal things are finally turning around. As a side note though, the saving's rate increased, meaning consumption decreased just a bit.

The rest of this week should continue to be interesting. Back in a March post I predicted that the Dow will be in the 9000-9500 range by August. That is actually looking very possible right now.

Subscribe to:

Posts (Atom)